AI Prompts: Unearthing Insights Beyond the Obvious

& There is an AI Agent for ‘That’

(Please add our email address to your contact list so that the next newsletter goes to your Inbox folder: InvestmentWriterAI@InvestmentWriterAI.com)

This article is for educational purposes only, and does not offer any financial advice or investment recommendation. Please contact a registered financial advisor in your jurisdiction before investing your money.

(First published on 9 January 2025)

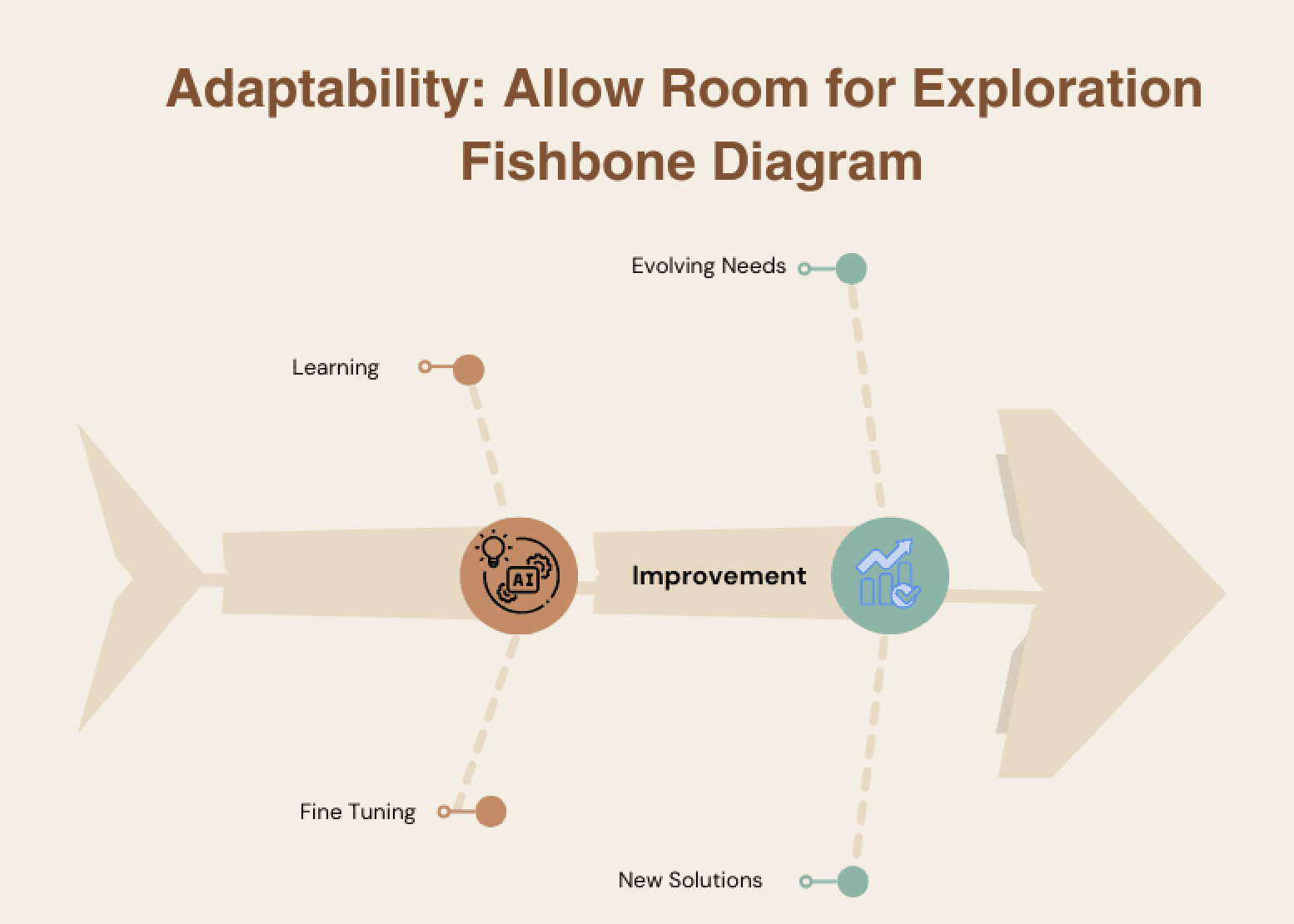

Artificial Intelligence (AI) is rapidly changing the way data is analyzed in investment research and finance. However, true innovation doesn’t stem solely from rigid rules; instead, it thrives on adaptability.

By incorporating flexibility into AI prompts, you can uncover outliers, anomalies, or trends that structured queries might overlook. In previous editions of our newsletter, we explored essential elements such as context, assigning roles, clarity, constraints, and articulating the desired outcome.

Building on that foundation, this edition focuses on how adaptability in AI prompts can spark unexpected insights while maintaining a balance between flexibility and structure. Below, we’ll examine two examples of inefficient prompts versus effective ones to illustrate the power of well-crafted adaptability in your queries.

1. Scenario-Based Exploration

Inefficient Prompt:

"What are the biggest risks for companies in 2025?"

Why it’s Inefficient:

Overly general and unfocused, offering little direction for AI to deliver actionable insights.

Effective Prompt:

“Analyze potential risks for global companies in the energy sector if the price of Brent crude oil price were to fall below US$60 per barrel in 2025. Identify outliers—companies that may benefit or suffer disproportionately—based on factors like operational costs, hedging strategies, and market share. Please provide references where applicable."

Why it Works:

- Focuses on a specific scenario while allowing room for unexpected insights.

- Enables exploration of winners and losers based on clearly defined factors.

- Leaves flexibility to identify outliers influenced by broader market trends.

2. Evaluating Macroeconomic Impacts on Commodities

Inefficient Prompt:

"What happens to commodity prices when interest rates change?"

Why it’s Inefficient:

Too broad, lacks specificity about the type of commodity, the direction of rate change, and the time frame, leaving little room for nuanced exploration.

Effective Prompt:

"Evaluate the impact of the recent Federal Reserve policy of interest rate decreases on global natural gas prices. Additionally, highlight any unexpected shifts in supply or demand dynamics that could influence future market movements in the energy sector, especially in natural gas. Please provide references where applicable."

Why it’s Effective:

- Combines structure and adaptability by specifying the economic policy and commodity.- Allows flexibility to surface anomalies like geopolitical tensions or energy demand shifts.

- Encourages a nuanced understanding of market dynamics.

Reader Spotlight: Exploring AI Agents

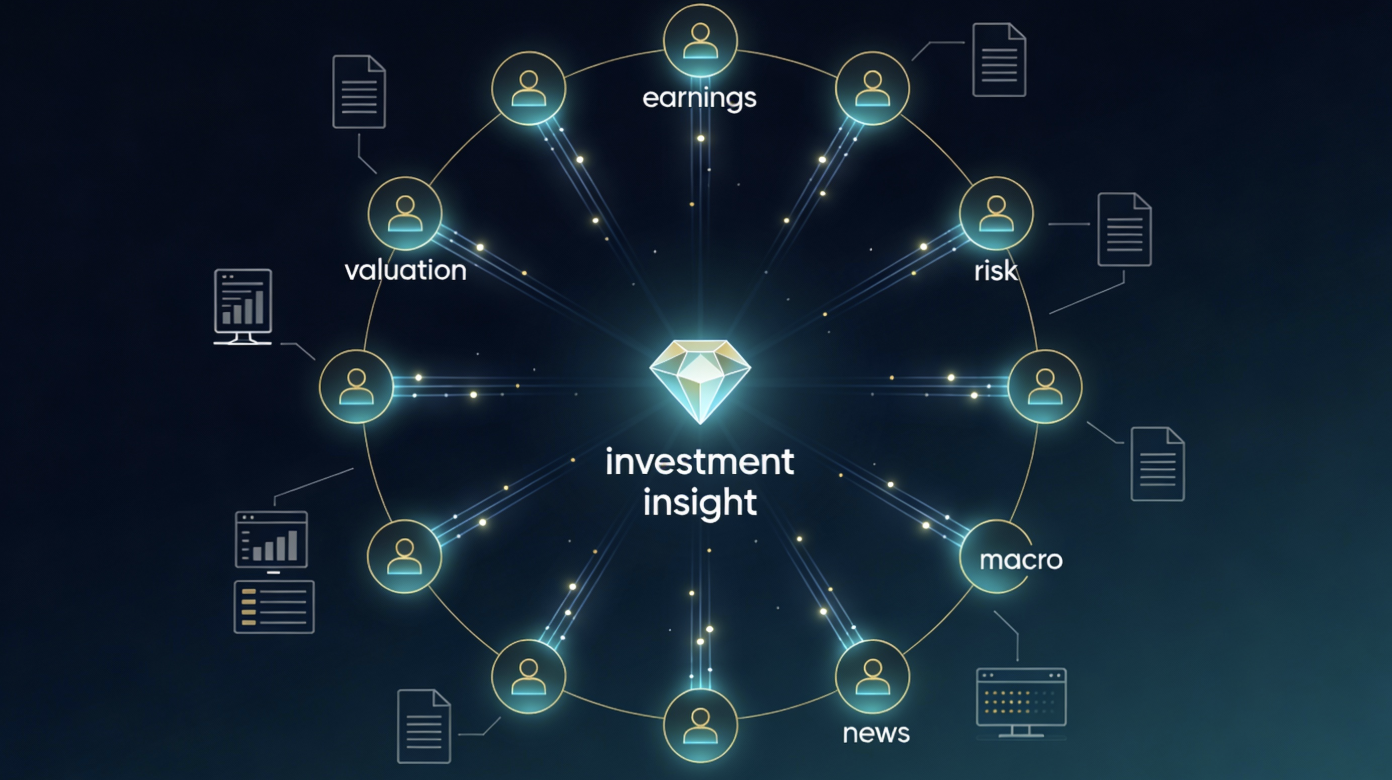

We’ve received many reader questions about AI agents and their potential in investment research. But what exactly are AI agents? Simply put, they are advanced tools that can work independently to complete tasks like analyzing data, writing reports, or creating investment strategies.

One exciting development in this space is Virtuals, a protocol built on blockchain technology. Virtuals allow AI agents to operate in a decentralized way, leveraging Ethereum’s Layer-2 Base. This innovation opens up new possibilities for managing finances, trading, and creating advanced tools.

In future editions, we’ll discuss into how AI agents can enhance your research process and also share practical tips to help you get started on using them in your professional and personal lives. Stay tuned!

Key Takeaway

Adaptability in prompts doesn’t mean losing focus—it’s about striking the perfect balance between structure and flexibility. By allowing AI the room to explore, you can uncover insights that rigid prompts might overlook. Experimenting with adaptable prompts can add depth to your analyses and help you identify trends before they emerge.

What’s your take on adaptability in prompting? Share your favorite strategies or prompts with us—your feedback helps us enhance and refine our content.

Coming Up:

In our next edition, we’ll discuss the Feedback Loop: Incorporating User Feedback. Stay tuned!

(Please add our email address to your contact list to ensure the next newsletter lands in your Inbox: investmentWriterAI@investmentwriterai.com)