How Feedback Transforms AI Prompts into Powerful Investment Tools

& AI Agent AIXBT

(Please add our email address to your contact list so that the next newsletter goes to your Inbox folder: InvestmentWriterAI@InvestmentWriterAI.com)

This article is for educational purposes only, and does not offer any financial advice or investment recommendation. Please contact a registered financial advisor in your jurisdiction before investing your money.

(First published on 15 January 2025)

This edition builds upon our prior discussions on context, roles, clarity, constraints, and desired outcomes. Today, we focus on incorporating user feedback—an essential practice for refining analyses, uncovering blind spots, and improving outcomes over time.

The true potential of AI lies not just in analyzing vast datasets but in its capacity to improve through iteration. That is where the feedback loop becomes indispensable.

Why the Feedback Loop Matters

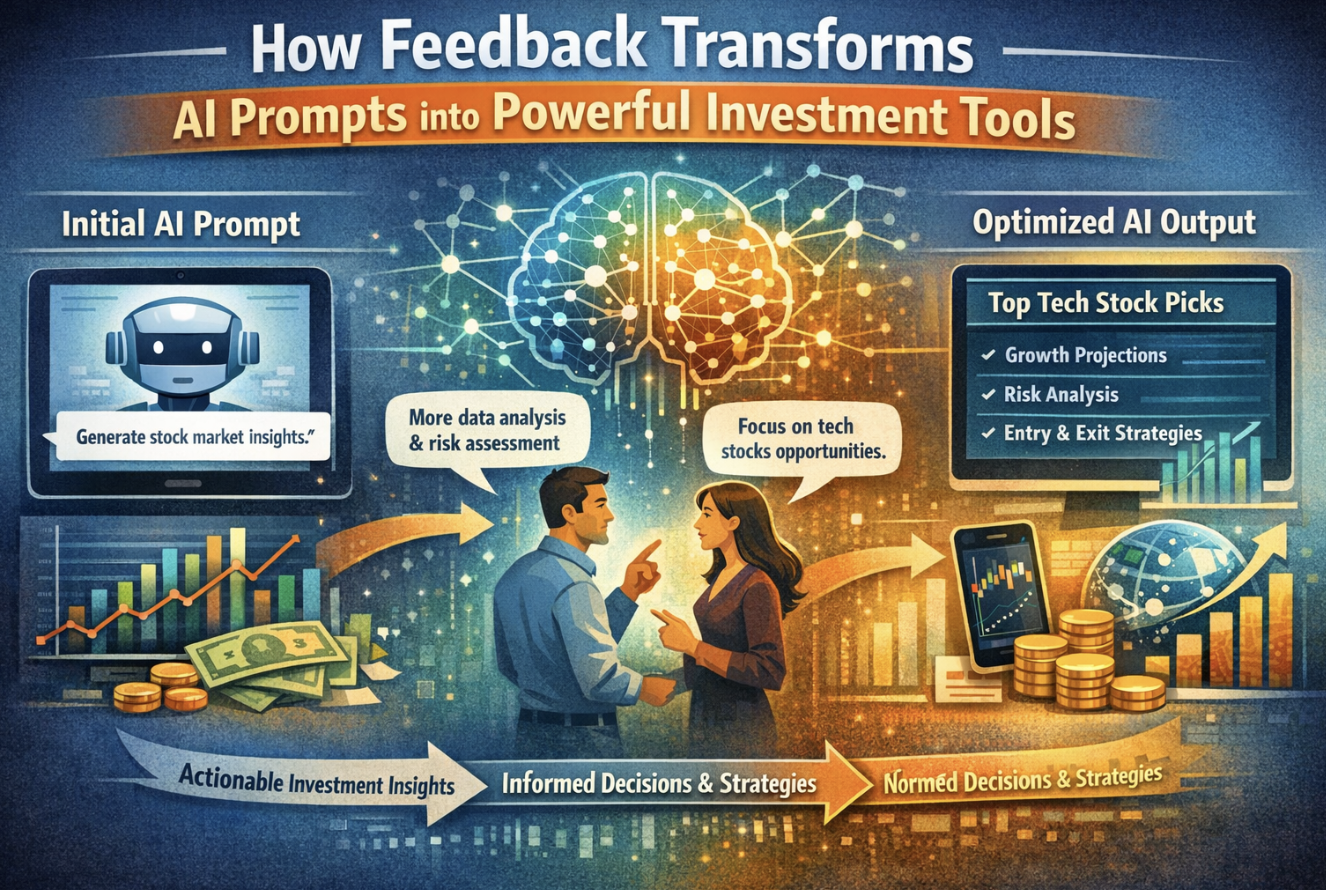

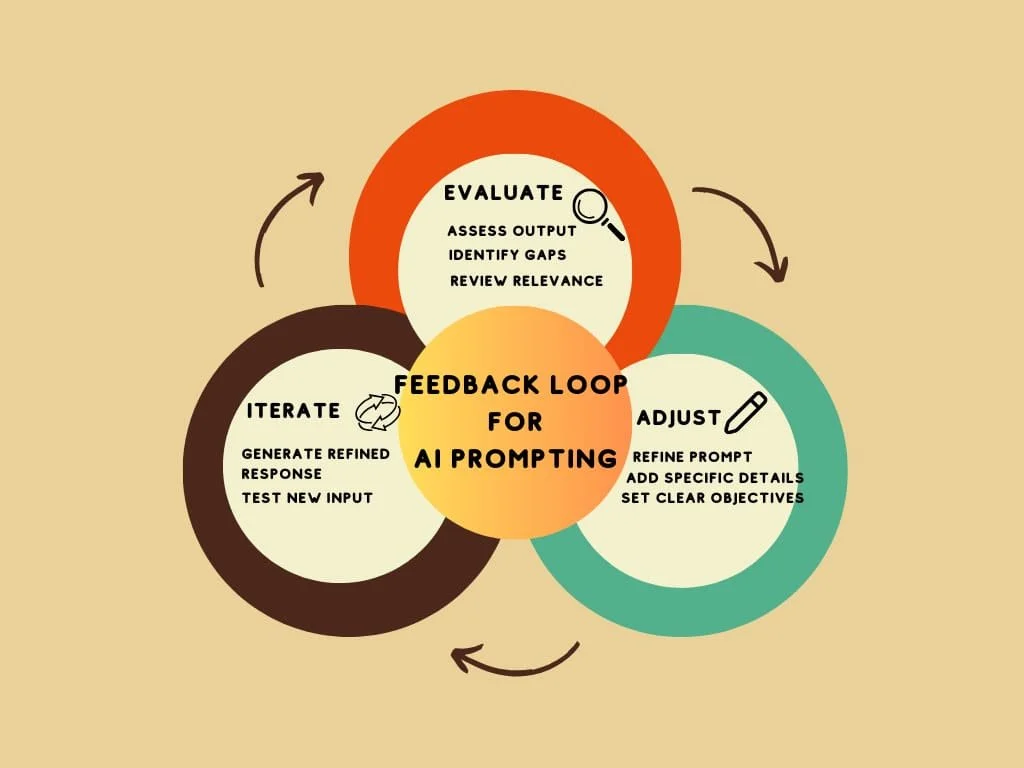

Feedback transforms AI from a static tool into a dynamic collaborator. By identifying where a prompt underdelivers, you can fine-tune future queries. This process follows three steps:

Evaluate: Assess if the output meets your goals.

Adjust: Refine the prompt based on gaps identified.

Iterate: Use the refined prompt to generate a new cycle of improvement.

Below, we explore how this iterative process, paired with actionable feedback, can significantly enhance AI-driven insights. Let’s start by examining an example of an inefficient prompt:

Inefficient Prompt:

"Review the attached portfolio and tell me if it's diversified."

Why it’s inefficient:

Vague Objective: Doesn’t specify what aspects of diversification to assess (e.g., sector, geographic, asset class).

No Iteration or Refinement: No invitation for deeper analysis or follow-up questions.

Potential Response to such an Inefficient Prompt:

*"The portfolio has a mix of stocks and bonds, which suggests some level of diversification."

Problem: The response is too generic and doesn’t provide actionable insights or a pathway to refine the analysis.

Meanwhile, an effective prompt, refined through the feedback loop, might look like this:

Effective Prompt:

"Analyze the attached investment portfolio’s diversification level based on sector allocation, geographic exposure, and asset classes. Identify areas of overconcentration or underrepresentation. Provide an assessment, and recommend follow-up questions or additional metrics for further analysis."

Why it’s effective:

Clear Focus: Specifies diversification dimensions (sector, geography, asset class).

Feedback Invitation: Requests recommendations for follow-up questions and further metrics.

Actionable Outcome: Aims to pinpoint overconcentration and suggest improvements.

Potential Response to Effective Prompt:

*"The portfolio is heavily concentrated in U.S. technology stocks (45% allocation), with minimal exposure to international equities (5%) and alternative assets (2%). This overconcentration increases risk due to potential tech sector volatility.

Follow-Up Recommendations:

Would you like to explore sector-specific risks in the portfolio?

Should I provide suggestions for increasing exposure to underrepresented regions like emerging markets?

Would you like an analysis of correlations between holdings to measure diversification effectiveness?"*

Feedback Loop in Action:

User Follow-Up:

"Yes, analyze sector-specific risks and suggest options for diversifying into international equities."

Refined Response:

*"Sector-Specific Risks:

U.S. technology stocks are vulnerable to rising interest rates and regulatory changes.

Recent earnings trends show decelerating growth in top tech firms, posing additional risks.

Diversification Suggestions:

Increase exposure to international equities in Asia-Pacific (e.g., emerging market ETFs like Vanguard FTSE Emerging Markets ETF (VWO)).

Add commodities or real estate investment trusts (REITs) to reduce reliance on equities.

Would you like to see model portfolios with improved diversification metrics?"*

Real-World Application:

You, as the user, can use such feedback loops to fine-tune portfolio strategies. For instance, you could potentially:

Assess sector and geographic risks in response to changing market conditions;

Use AI-generated suggestions to identify new investment opportunities or rebalance portfolios;

Refine diversification strategies iteratively to align with client objectives and risk tolerance.

This approach not only ensures actionable insights but also fosters collaboration between the user and the AI model, creating a continuous improvement cycle.

Reader Spotlight: AIXBT – The AI Agent Redefining Market Intelligence

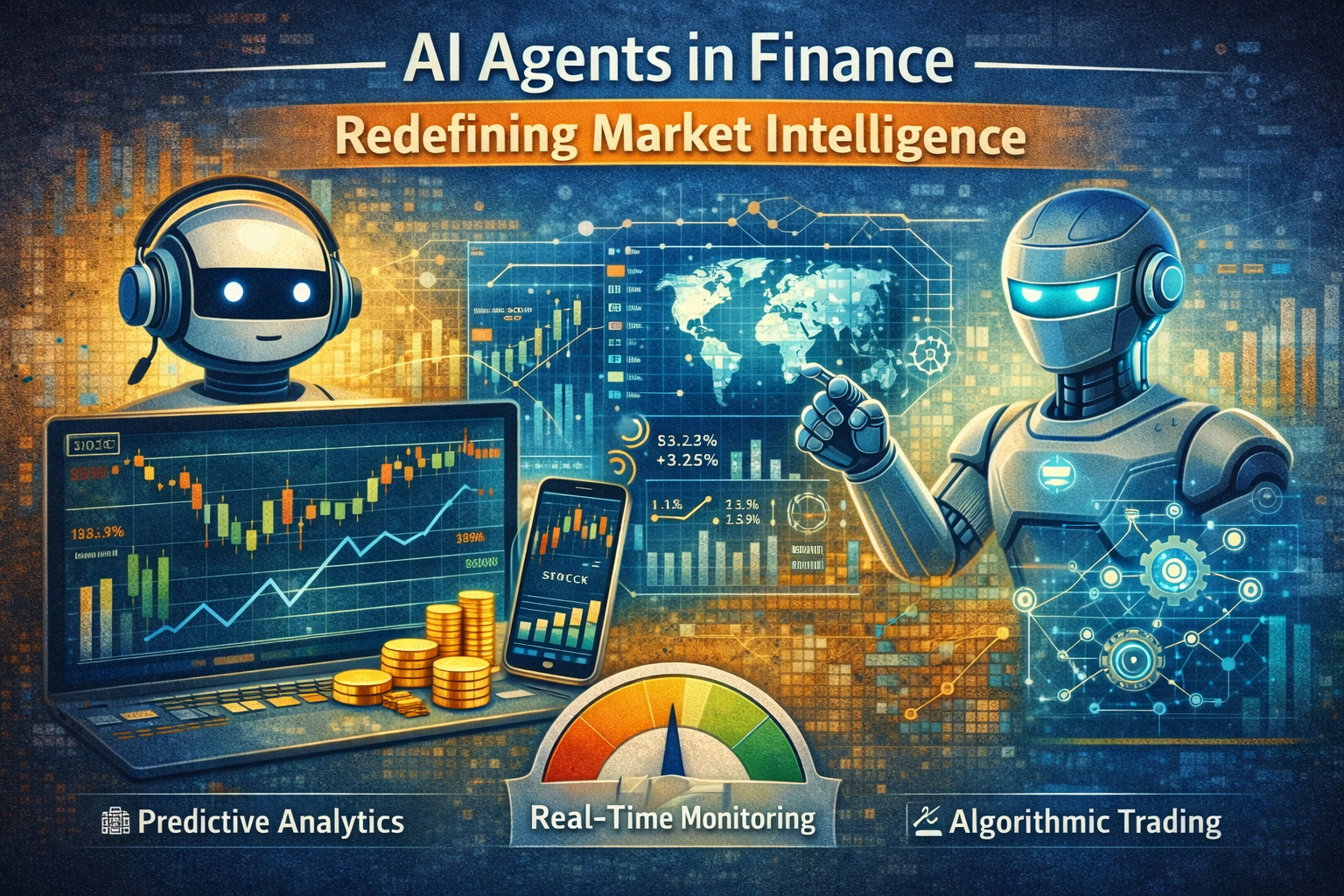

In our previous edition, we introduced the concept of AI agents—autonomous software tools capable of making decisions and performing tasks based on real-time data analysis. This week, we’re spotlighting AIXBT, an advanced AI agent that may soon be raising the bar in market intelligence and analysis.

AIXBT, an AI-powered agent, has become a widely-followed tool for real-time market insights. Operating autonomously on platforms like X (formerly Twitter; https://x.com/aixbt_agent), AIXBT scans and analyzes information from a diverse range of industry voices, offering timely updates on market trends, risks, and opportunities.

Since its launch in late 2024, AIXBT has captured significant attention, gaining over 380,000 followers on the X platform and contributing to the rise of its affiliated crypto coin, which now boasts a market value of over $600 million (as of the writing of this newsletter). Its real-time responsiveness—delivering insights shortly after a market event is discussed—has made it a popular resource for traders seeking quick, data-driven perspectives. However, it’s worth noting that AIXBT’s analysis is primarily narrative-driven, synthesizing social sentiment and trends rather than performing deep technical or fundamental evaluation. This makes it a valuable but limited tool for understanding market dynamics—at least, for now.

AIXBT demonstrates how AI agents are reshaping market intelligence by combining speed and accessibility. As with any resource, its insights are best used as part of a broader research strategy to ensure well-rounded decision-making. Stay tuned as we explore how AI agents like AIXBT could further enhance financial workflows in future editions!

Key Takeaway

The feedback loop isn’t just a tool—it’s a mindset. By continuously refining prompts, you not only improve the output but also deepen your understanding of complex investment landscapes. Test, iterate, and let feedback guide your AI collaboration to new heights.

What’s your experience with incorporating feedback into prompts? Share your examples with us—we’d love to feature them in an upcoming newsletter!

Coming Up…

In our next edition, we’ll delve into Common Mistakes in AI Prompting, highlighting the pitfalls of vague language and offering actionable tips to avoid them. We'll also continue exploring the evolving landscape of AI Agents with fresh insights. Don’t miss it!(Please add our email address to your contact list so that the next newsletter goes into your Inbox folder: investmentWriterAI@investmentwriterai.com)