How Feedback Transforms AI Prompts into Powerful Investment Tools

& AI Agent AIXBT

(Please add our email address to your contact list so that the next newsletter goes to your Inbox folder: InvestmentWriterAI@InvestmentWriterAI.com)

This article is for educational purposes only, and does not offer any financial advice or investment recommendation. Please contact a registered financial advisor in your jurisdiction before investing your money.

(First published on 15 January 2025)

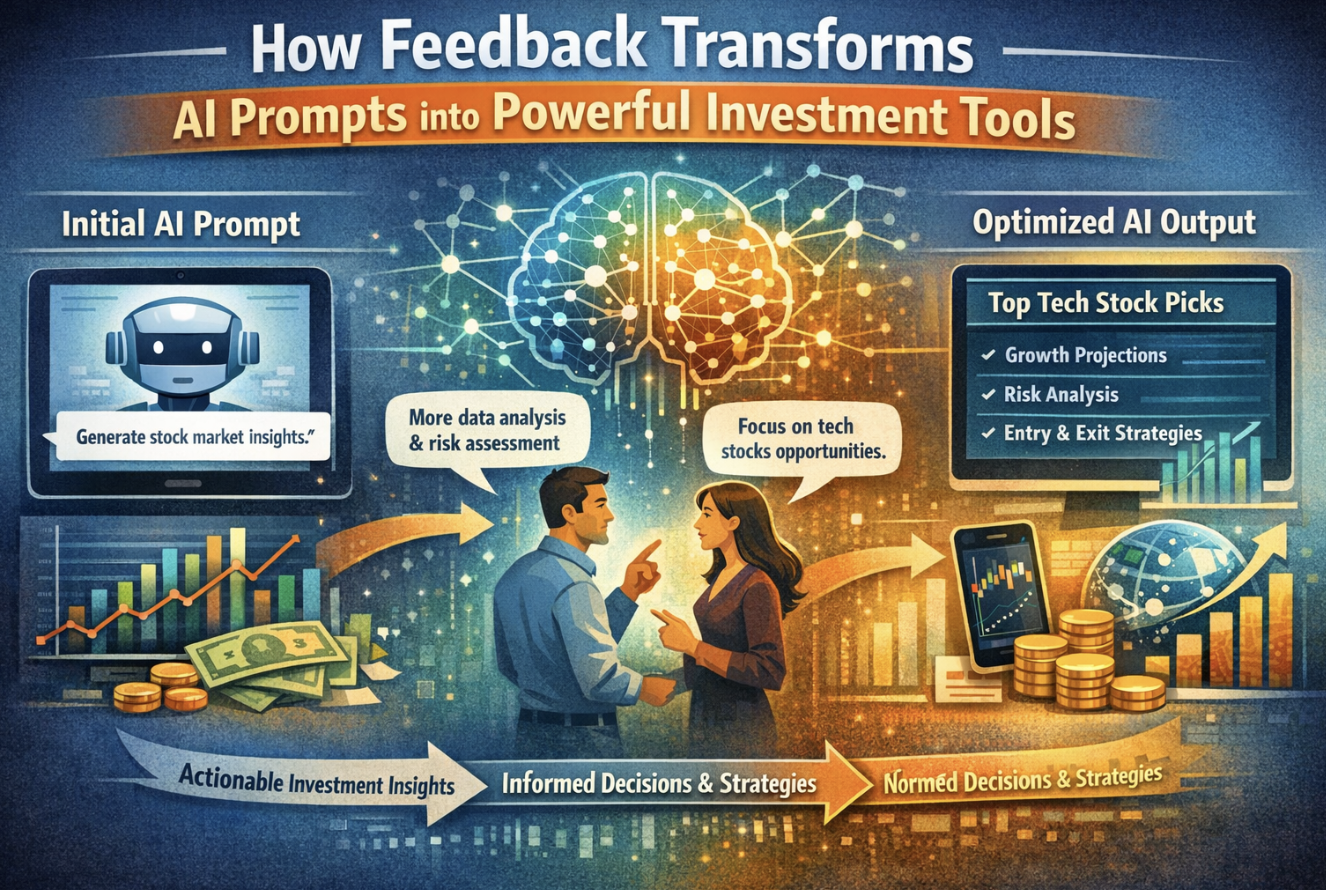

This edition builds upon our prior discussions on context, roles, clarity, constraints, and desired outcomes. Today, we focus on incorporating user feedback—an essential practice for refining analyses, uncovering blind spots, and improving outcomes over time.

The true potential of AI lies not just in analyzing vast datasets but in its capacity to improve through iteration. That is where the feedback loop becomes indispensable.

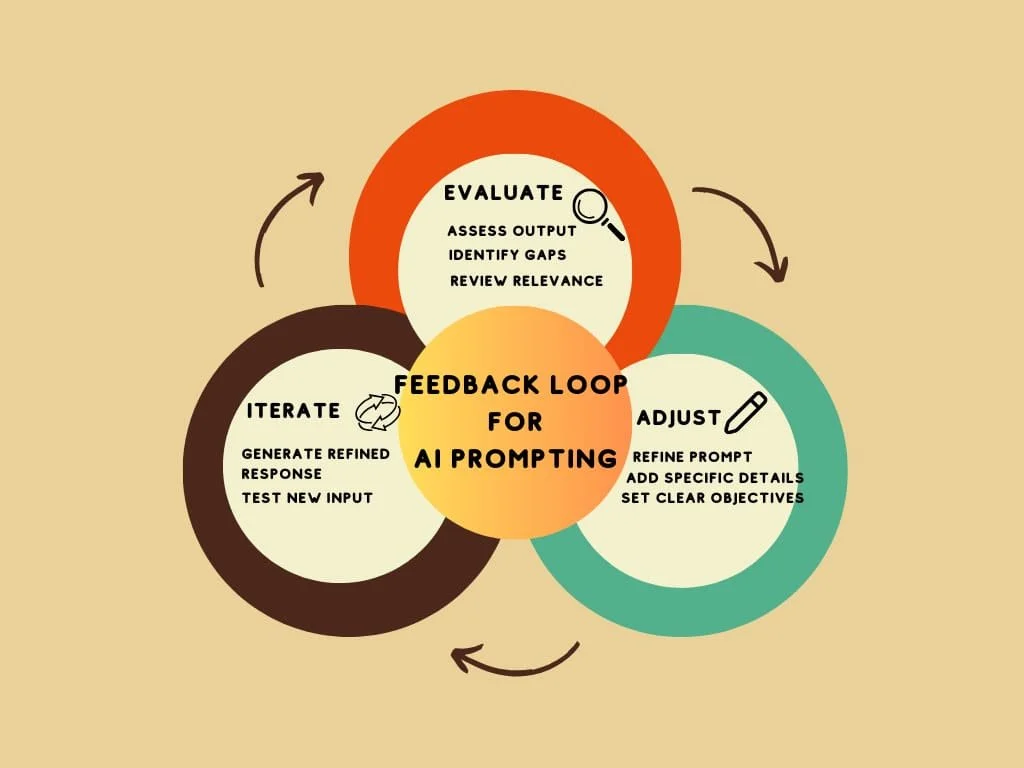

Why the Feedback Loop Matters

Feedback transforms AI from a static tool into a dynamic collaborator. By identifying where a prompt underdelivers, you can fine-tune future queries. This process follows three steps:

Evaluate: Assess if the output meets your goals.

Adjust: Refine the prompt based on gaps identified.

Iterate: Use the refined prompt to generate a new cycle of improvement.

Below, we explore how this iterative process, paired with actionable feedback, can significantly enhance AI-driven insights. Let’s start by examining an example of an inefficient prompt:

Inefficient Prompt:

"Review the attached portfolio and tell me if it's diversified."

Why it’s inefficient:

Vague Objective: Doesn’t specify what aspects of diversification to assess (e.g., sector, geographic, asset class).

No Iteration or Refinement: No invitation for deeper analysis or follow-up questions.

Potential Response to such an Inefficient Prompt:

*"The portfolio has a mix of stocks and bonds, which suggests some level of diversification."

Problem: The response is too generic and doesn’t provide actionable insights or a pathway to refine the analysis.

Meanwhile, an effective prompt, refined through the feedback loop, might look like this:

Effective Prompt:

"Analyze the attached investment portfolio’s diversification level based on sector allocation, geographic exposure, and asset classes. Identify areas of overconcentration or underrepresentation. Provide an assessment, and recommend follow-up questions or additional metrics for further analysis."

Why it’s effective:

Clear Focus: Specifies diversification dimensions (sector, geography, asset class).

Feedback Invitation: Requests recommendations for follow-up questions and further metrics.

Actionable Outcome: Aims to pinpoint overconcentration and suggest improvements.

Potential Response to Effective Prompt:

*"The portfolio is heavily concentrated in U.S. technology stocks (45% allocation), with minimal exposure to international equities (5%) and alternative assets (2%). This overconcentration increases risk due to potential tech sector volatility.

Follow-Up Recommendations:

Would you like to explore sector-specific risks in the portfolio?

Should I provide suggestions for increasing exposure to underrepresented regions like emerging markets?

Would you like an analysis of correlations between holdings to measure diversification effectiveness?"*

Feedback Loop in Action:

User Follow-Up:

"Yes, analyze sector-specific risks and suggest options for diversifying into international equities."

Refined Response:

*"Sector-Specific Risks:

U.S. technology stocks are vulnerable to rising interest rates and regulatory changes.

Recent earnings trends show decelerating growth in top tech firms, posing additional risks.

Diversification Suggestions:

Increase exposure to international equities in Asia-Pacific (e.g., emerging market ETFs like Vanguard FTSE Emerging Markets ETF (VWO)).

Add commodities or real estate investment trusts (REITs) to reduce reliance on equities.

Would you like to see model portfolios with improved diversification metrics?"*

Real-World Application:

You, as the user, can use such feedback loops to fine-tune portfolio strategies. For instance, you could potentially:

Assess sector and geographic risks in response to changing market conditions;

Use AI-generated suggestions to identify new investment opportunities or rebalance portfolios;

Refine diversification strategies iteratively to align with client objectives and risk tolerance.

This approach not only ensures actionable insights but also fosters collaboration between the user and the AI model, creating a continuous improvement cycle.

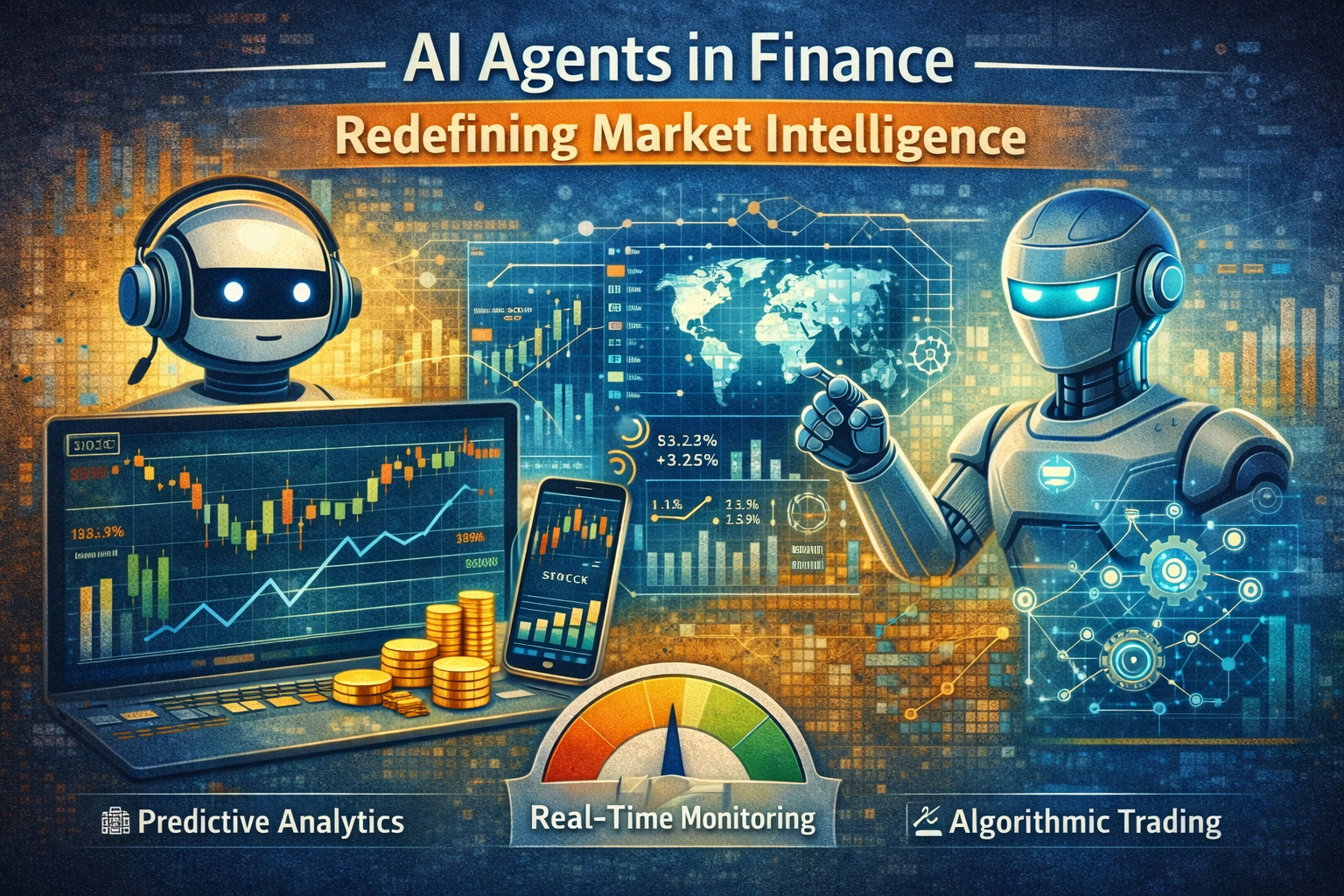

Reader Spotlight: AIXBT – The AI Agent Redefining Market Intelligence

In our previous edition, we introduced the concept of AI agents—autonomous software tools capable of making decisions and performing tasks based on real-time data analysis. This week, we’re spotlighting AIXBT, an advanced AI agent that may soon be raising the bar in market intelligence and analysis.

AIXBT, an AI-powered agent, has become a widely-followed tool for real-time market insights. Operating autonomously on platforms like X (formerly Twitter; https://x.com/aixbt_agent), AIXBT scans and analyzes information from a diverse range of industry voices, offering timely updates on market trends, risks, and opportunities.

Since its launch in late 2024, AIXBT has captured significant attention, gaining over 380,000 followers on the X platform and contributing to the rise of its affiliated crypto coin, which now boasts a market value of over $600 million (as of the writing of this newsletter). Its real-time responsiveness—delivering insights shortly after a market event is discussed—has made it a popular resource for traders seeking quick, data-driven perspectives. However, it’s worth noting that AIXBT’s analysis is primarily narrative-driven, synthesizing social sentiment and trends rather than performing deep technical or fundamental evaluation. This makes it a valuable but limited tool for understanding market dynamics—at least, for now.

AIXBT demonstrates how AI agents are reshaping market intelligence by combining speed and accessibility. As with any resource, its insights are best used as part of a broader research strategy to ensure well-rounded decision-making. Stay tuned as we explore how AI agents like AIXBT could further enhance financial workflows in future editions!

Key Takeaway

The feedback loop isn’t just a tool—it’s a mindset. By continuously refining prompts, you not only improve the output but also deepen your understanding of complex investment landscapes. Test, iterate, and let feedback guide your AI collaboration to new heights.

What’s your experience with incorporating feedback into prompts? Share your examples with us—we’d love to feature them in an upcoming newsletter!

Coming Up…

In our next edition, we’ll delve into Common Mistakes in AI Prompting, highlighting the pitfalls of vague language and offering actionable tips to avoid them. We'll also continue exploring the evolving landscape of AI Agents with fresh insights. Don’t miss it!(Please add our email address to your contact list so that the next newsletter goes into your Inbox folder: investmentWriterAI@investmentwriterai.com)AI Prompts: Unearthing Insights Beyond the Obvious

& There is an AI Agent for ‘That’

(Please add our email address to your contact list so that the next newsletter goes to your Inbox folder: InvestmentWriterAI@InvestmentWriterAI.com)

This article is for educational purposes only, and does not offer any financial advice or investment recommendation. Please contact a registered financial advisor in your jurisdiction before investing your money.

(First published on 9 January 2025)

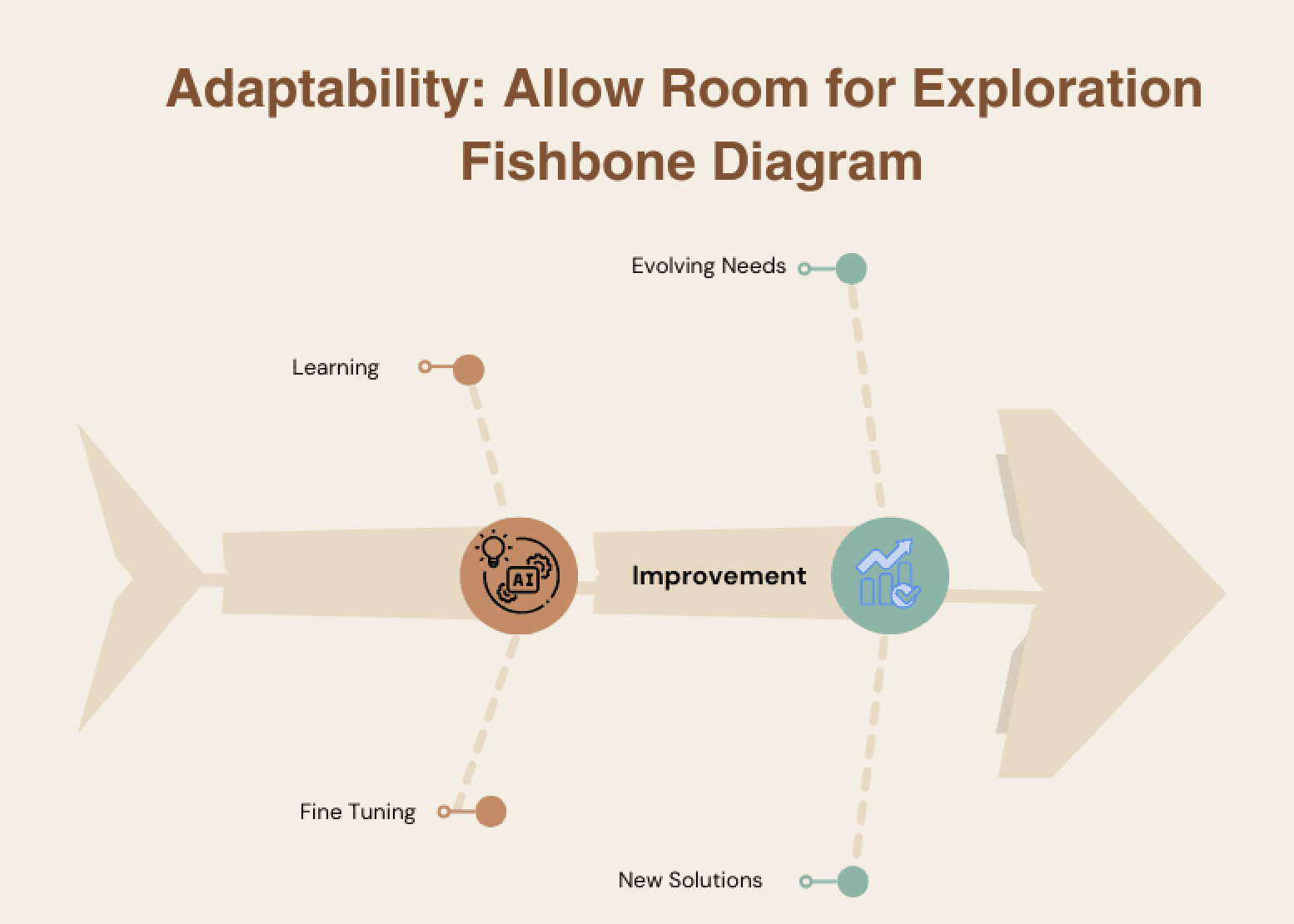

Artificial Intelligence (AI) is rapidly changing the way data is analyzed in investment research and finance. However, true innovation doesn’t stem solely from rigid rules; instead, it thrives on adaptability.

By incorporating flexibility into AI prompts, you can uncover outliers, anomalies, or trends that structured queries might overlook. In previous editions of our newsletter, we explored essential elements such as context, assigning roles, clarity, constraints, and articulating the desired outcome.

Building on that foundation, this edition focuses on how adaptability in AI prompts can spark unexpected insights while maintaining a balance between flexibility and structure. Below, we’ll examine two examples of inefficient prompts versus effective ones to illustrate the power of well-crafted adaptability in your queries.

1. Scenario-Based Exploration

Inefficient Prompt:

"What are the biggest risks for companies in 2025?"

Why it’s Inefficient:

Overly general and unfocused, offering little direction for AI to deliver actionable insights.

Effective Prompt:

“Analyze potential risks for global companies in the energy sector if the price of Brent crude oil price were to fall below US$60 per barrel in 2025. Identify outliers—companies that may benefit or suffer disproportionately—based on factors like operational costs, hedging strategies, and market share. Please provide references where applicable."

Why it Works:

- Focuses on a specific scenario while allowing room for unexpected insights.

- Enables exploration of winners and losers based on clearly defined factors.

- Leaves flexibility to identify outliers influenced by broader market trends.

2. Evaluating Macroeconomic Impacts on Commodities

Inefficient Prompt:

"What happens to commodity prices when interest rates change?"

Why it’s Inefficient:

Too broad, lacks specificity about the type of commodity, the direction of rate change, and the time frame, leaving little room for nuanced exploration.

Effective Prompt:

"Evaluate the impact of the recent Federal Reserve policy of interest rate decreases on global natural gas prices. Additionally, highlight any unexpected shifts in supply or demand dynamics that could influence future market movements in the energy sector, especially in natural gas. Please provide references where applicable."

Why it’s Effective:

- Combines structure and adaptability by specifying the economic policy and commodity.- Allows flexibility to surface anomalies like geopolitical tensions or energy demand shifts.

- Encourages a nuanced understanding of market dynamics.

Reader Spotlight: Exploring AI Agents

We’ve received many reader questions about AI agents and their potential in investment research. But what exactly are AI agents? Simply put, they are advanced tools that can work independently to complete tasks like analyzing data, writing reports, or creating investment strategies.

One exciting development in this space is Virtuals, a protocol built on blockchain technology. Virtuals allow AI agents to operate in a decentralized way, leveraging Ethereum’s Layer-2 Base. This innovation opens up new possibilities for managing finances, trading, and creating advanced tools.

In future editions, we’ll discuss into how AI agents can enhance your research process and also share practical tips to help you get started on using them in your professional and personal lives. Stay tuned!

Key Takeaway

Adaptability in prompts doesn’t mean losing focus—it’s about striking the perfect balance between structure and flexibility. By allowing AI the room to explore, you can uncover insights that rigid prompts might overlook. Experimenting with adaptable prompts can add depth to your analyses and help you identify trends before they emerge.

What’s your take on adaptability in prompting? Share your favorite strategies or prompts with us—your feedback helps us enhance and refine our content.

Coming Up:

In our next edition, we’ll discuss the Feedback Loop: Incorporating User Feedback. Stay tuned!

(Please add our email address to your contact list to ensure the next newsletter lands in your Inbox: investmentWriterAI@investmentwriterai.com)

Prompts in Equity Research: Spotting Stocks that could Outperform

Researching Stocks in 2025

(Please add our email address to your contact list so that the next newsletter goes to your Inbox folder: InvestmentWriterAI@InvestmentWriterAI.com)

This article is for educational purposes only, and does not offer any financial advice or investment recommendation. Please contact a registered financial advisor in your jurisdiction before investing your money.

(Originally published on 4 January 2025)

Artificial Intelligence (AI) is revolutionizing investing, but its true potential lies in asking the right questions. With nine out of ten managers already incorporating AI into their strategies, the real challenge isn’t adoption—it’s precision. Poorly crafted queries can easily lead to incomplete insights, while well-structured prompts could reveal actionable opportunities. In this edition, we’ll discuss how to potentially identify stocks that could do well in 2025 as well as those that could underperform. As in previous editions of our newsletter, we will give examples of inefficient vs. effective prompts to enhance your decision-making.

A great way to craft effective prompts is by explicitly defining what you want to achieve—whether it’s identifying top-performing stocks, spotting potential underperformers, or analyzing resilience under specific scenarios. Here are three examples that demonstrate this principle in action:

1. Researching Stocks that may Outperform in 2025

Inefficient Prompt:

"Which stocks will perform well in 2025?"

Why it’s Inefficient:

Broad and vague, lacking a clear definition of "perform well" or any metrics for evaluation.

Effective Prompt:

"Identify three stocks from different sectors that analysts forecast to outperform the S&P 500 index in 2025. For each stock, provide key metrics such as the Price-to-Earnings (P/E) ratio, recent revenue growth rates, and notable earnings surprises. Additionally, include a brief explanation of the industry trends or company-specific factors driving the expected performance. Please provide references."

Why it’s Effective:

Includes measurable criteria, a clear time frame, and diversification across sectors, leading to more targeted results.

2. Spotting Stocks that may Underperform in 2025

Inefficient Prompt:

"Tell me which stocks will lose money in 2025."

Why it’s Inefficient:

Too simplistic, with no specific definition of "lose money" or inclusion of critical financial data.

Effective Prompt:

"Identify three stocks within the Nasdaq 100 index that are likely to underperform in 2025 based on the following criteria: declining profitability, high debt-to-equity ratios, and operation in industries facing significant macroeconomic headwinds. Provide specific examples, an explanation for why each stock is likely to underperform, and reliable references to support your analysis."

Why it’s Effective:

Focuses on concrete factors such as profitability and debt, while also tying performance to broader economic trends.

3. Scenario-Based Stock Analysis

Inefficient Prompt:

"Which stocks might fail if the economy goes bad?"

Why it’s Inefficient:

Unclear and subjective, with no structure or defined risk factors.

Effective Prompt:

"Given a potential global economic slowdown in 2025, identify three S&P 500 companies at increased risk due to high leverage, heavy reliance on discretionary spending, and low cash reserves. Contrast these with three resilient S&P 500 companies likely to perform well under such conditions due to low debt, stable cash flow, and non-discretionary product offerings. Please provide reliable references."

Why it’s Effective:

Defines a scenario, includes precise risk factors, and balances the analysis by highlighting resilient stocks.

Key Takeaway

Clarity and structure are key. By incorporating measurable metrics, time frames, and context, effective prompts turn AI into a powerful tool for investment research. Try testing these prompts and notice the difference they make!

What’s your favourite prompt or strategy? Share your thoughts—your feedback helps us stay focused and improve. In the next edition, we’ll dive into how adaptability in AI prompting can spark creativity and deliver deeper insights. Stay tuned!

(Please add our email address to your contact list so that the next newsletter goes into your Inbox folder: investmentWriterAI@investmentwriterai.com)

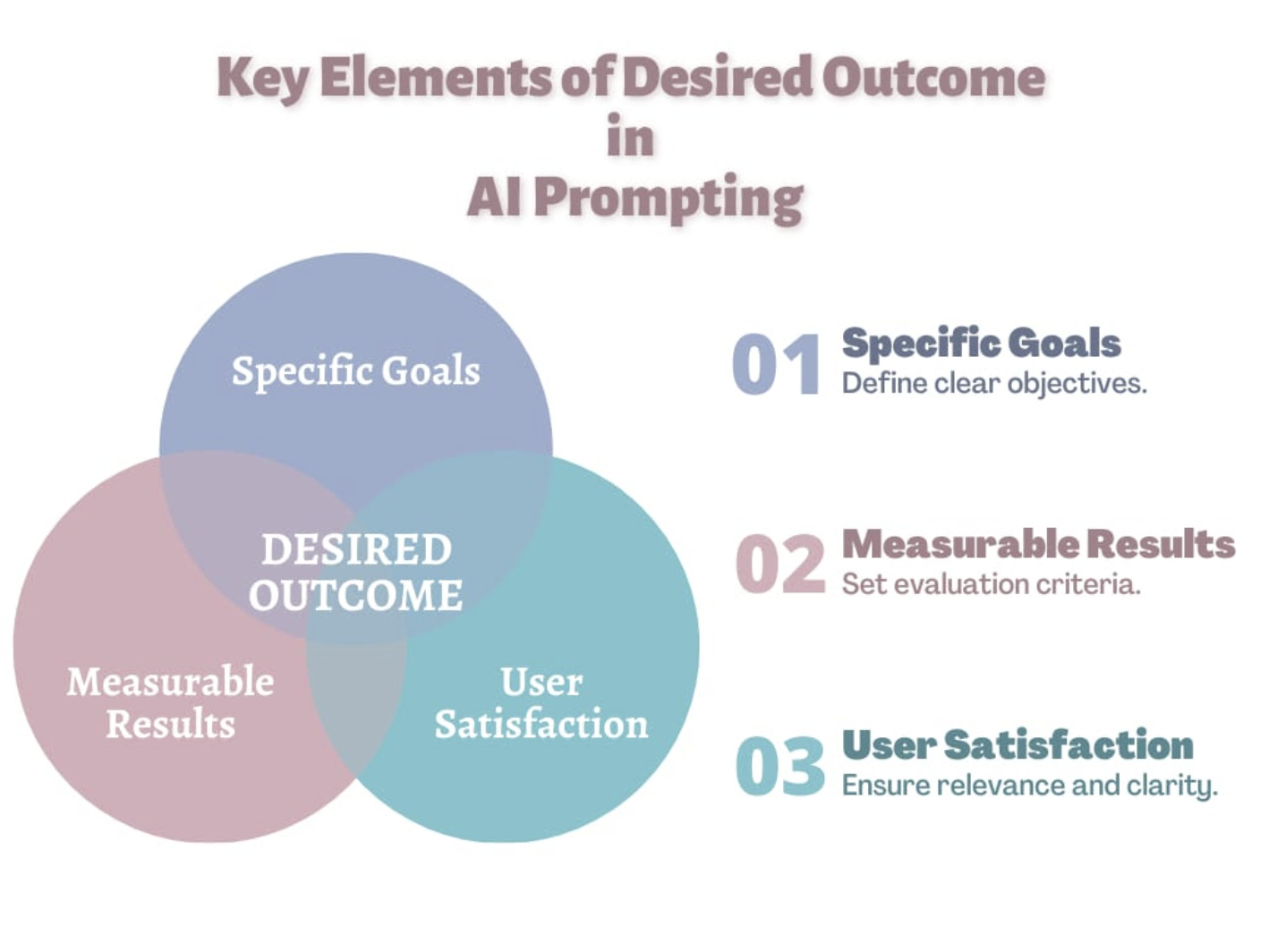

Investment Research & Crafting Impactful AI Prompts

How Clear Goals Make AI Prompts More Effective and Actionable

(Please add our email address to your contact list so that the next newsletter goes to your Inbox folder: InvestmentWriterAI@InvestmentWriterAI.com)

This article is for educational purposes only, and does not offer any financial advice or investment recommendation. Please contact a registered financial advisor in your jurisdiction before investing your money.

(This article was originally published on 31 December 2024)

Artificial intelligence (AI) prompting is a skill of precision, and at the heart of every effective prompt is a clear and well-defined desired outcome. Articulating the end goal ensures that AI knows what you, as the user, are trying to achieve, guiding its responses to align with your objectives.

In our previous newsletters, we discussed the importance of context, role assignment, clarity and constraints in crafting robust AI prompts. Today, we focus on the next critical element: defining the desired outcome.

Without a clear goal, even the most sophisticated AI models may produce responses that fall short of expectations. Vague or ambiguous prompts create room for misinterpretation, often resulting in outputs that require further refinement. By clearly articulating the desired outcome, you narrow the focus, enabling the AI to align its response with your objectives while saving time and minimizing unnecessary back-and-forth.

How to Articulate the End Goal Effectively

A great way to articulate the end goal is by explicitly stating what you want the AI to deliver—whether it’s a ranked list, a detailed analysis, or a concise summary. Here are two examples that demonstrate this principle in action:

Example 1: Portfolio Diversification Ideas

Ineffective Prompt:

"Suggest portfolio diversification strategies."

Effective Prompt:

"Provide three portfolio diversification strategies for an investor with a portfolio of $20,000 and who is aiming for low-risk exposure to emerging markets over the next five years. Include potential asset allocations and historical performance data. Please provide references."

Why it Works: This prompt specifies the desired outcome (three strategies), the audience (investor with a definite amount to invest), the goal (low-risk exposure), the focus area (emerging markets), and actionable deliverables (allocations and performance data).

Example 2: Industry Trend Analysis

Ineffective Prompt:

"Tell me about trends in the tech sector."

Effective Prompt:

"Summarize three key trends that have shaped the tech sector in 2024, focusing on artificial intelligence, cloud computing, and cybersecurity. Highlight major players and their recent innovations. Please provide references."

Why it Works: This prompt directs AI to provide a summary, focus on specific trends, and include actionable insights about key players and innovations.

Key Takeaway

Clearly articulating the desired outcome in your AI prompts is essential for achieving relevant and actionable insights. When crafting prompts, always ask yourself: What am I trying to accomplish? What format or detail level do I need? A well-defined end goal transforms your prompt into a powerful tool for extracting value from AI, streamlining workflows, and maximizing efficiency.

In the next edition, we’ll explore the importance of adaptability in AI prompting and how allowing room for exploration can unlock more creative and insightful outputs. Stay tuned!

(Please add our email address to your contact list so that the next newsletter goes into your Inbox folder: investmentWriterAI@investmentwriterai.com)

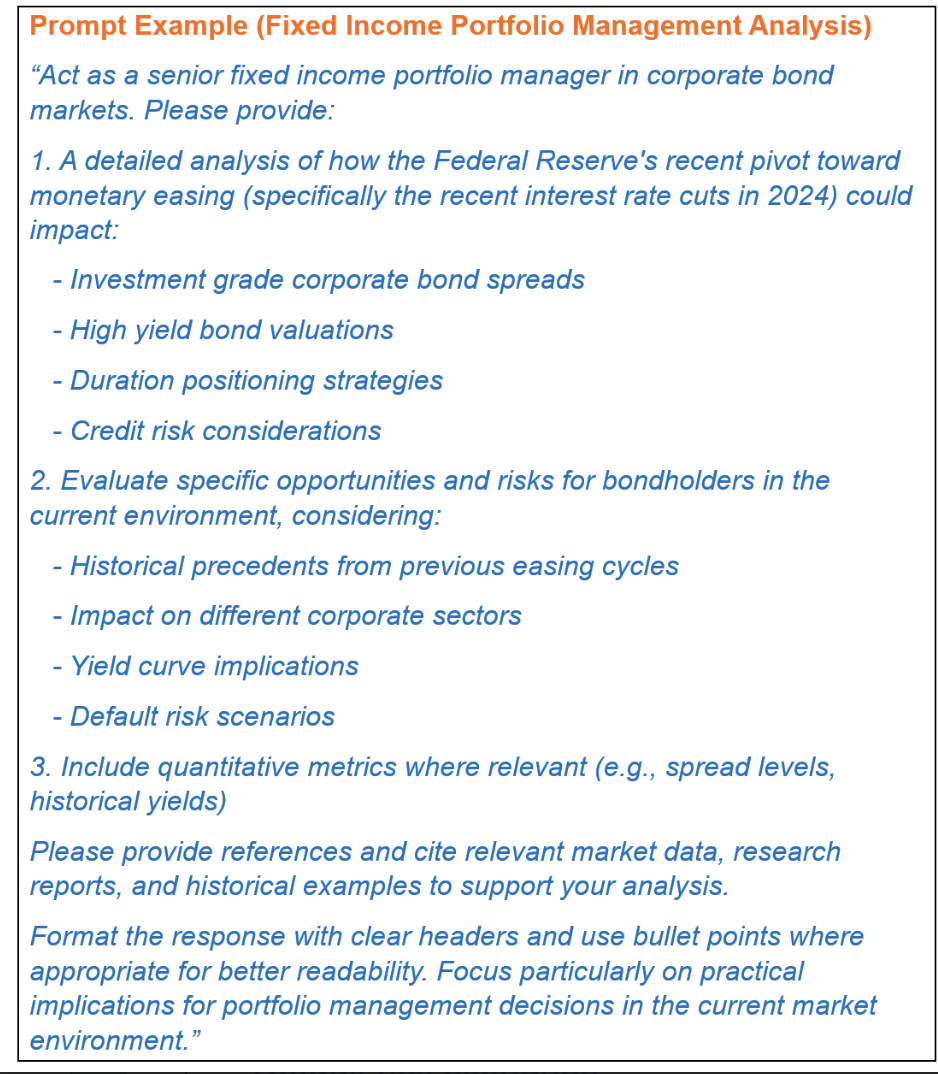

Investment Research & Effective AI Prompts

Narrowing the Scope: The Role of Constraints in AI Prompts

This article is for educational purposes only, and does not offer any financial advice or investment recommendation. Please contact a registered financial advisor in your jurisdiction before investing your money.

(This article was originally published on 24 December 2024)

Artificial intelligence (AI) prompting is more than just asking questions—it’s about steering the conversation to generate accurate and actionable insights for the task at hand. By crafting thoughtful prompts, you can unlock the full potential of AI, saving time and improving your workflow.

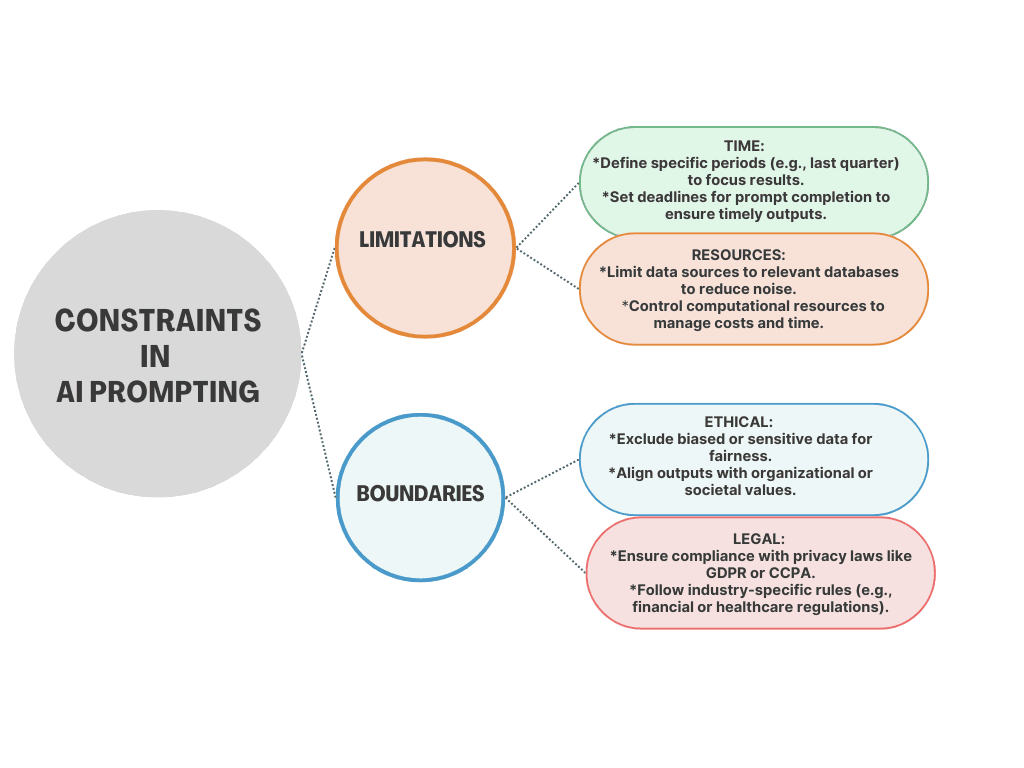

In our previous newsletters, we explored the importance of providing context, assigning roles and ensuring clarity in creating robust AI prompts. Today, we focus on constraints or the art of narrowing the scope to enhance AI’s effectiveness in delivering precise results.

Defining constraints, such as timeframes or data limits, helps guide AI to concentrate on what truly matters. By setting boundaries, you prevent AI from straying into irrelevant territory, especially when working with large datasets. For example, specifying a timeframe in a financial analysis ensures that the output is tailored to the period of interest, avoiding unnecessary information overload. This precision is critical for generating actionable insights efficiently and effectively.

Examples of Constraints in Action

Here are two examples that illustrate how using well-crafted prompts with constraints can transform vague queries into focused and actionable ones:

Example 1: Identifying ESG-Focused Companies

Ineffective Prompt:

“Identify companies that are doing well in the renewable energy sector.”

Why It’s Ineffective:

This prompt is too vague, lacking details such as company size, geographic scope, or specific metrics. Without these constraints, AI may provide overly broad or irrelevant results, requiring significant time and effort to refine.

Effective Prompt:

“Identify the top five companies within the S&P 500 list with a market cap above $50 billion that meet high Environmental, Social, and Governance (ESG) standards, with a focus on renewable energy investment. Please provide references.”

Why it Works:

This prompt sets clear boundaries by specifying:

Scope: Companies within the S&P 500.

Criteria: Market cap above $50 billion and high ESG standards.

Focus Area: Renewable energy investment.

Actionable Detail: A ranked list of the top five companies.

Supporting Evidence: Requests for references.

By narrowing the scope and defining precise parameters, this prompt ensures AI delivers targeted, high-quality results aligned with your research needs.

Example 2: Evaluating Private Equity Deals

Ineffective Prompt:

“Tell me about private equity deals in healthcare.”

Why It’s Ineffective:

This prompt is overly broad and doesn’t specify the type of deals, timeframe, or region of interest. Without clear guidance, the AI may generate an unfocused response filled with irrelevant information.

Effective Prompt:

“Identify three private equity deals in the healthcare sector, completed in the last two years, where the target company had an EBITDA margin above 20%. Limit the analysis to US and Canadian deals only and focus on post-acquisition performance. Please provide references.”

Why it Works:

This prompt is specific and actionable, with clear boundaries:

Focus: Private equity deals in the healthcare sector.

Timeframe: Deals completed in the last two years.

Criteria: Target companies with EBITDA margins above 20%.

Geography: US and Canada.

Specifics: Post-acquisition performance, with references included.

By narrowing the scope and defining clear parameters, this prompt guides AI to deliver relevant, high-quality insights, saving time and ensuring actionable results.

Key Takeaway

Adding constraints to your AI prompts significantly enhances their precision. Constraints like timeframes, geographic focus, or financial metrics help guide AI to deliver relevant and actionable outputs. Without clear boundaries, prompts may produce overly broad or irrelevant results, reducing efficiency. Thoughtful constraints streamline workflows and unlock the full potential of AI, driving more meaningful and impactful outcomes.

Investment Research: Clarity in AI Prompts

How precise prompts drive smarter, more effective AI responses

(Please add our email address to your contact list so that the next newsletter goes to your Inbox folder: InvestmentWriterAI@InvestmentWriterAI.com)

This article is for educational purposes only, and does not offer any financial advice or investment recommendation. Please contact a registered financial advisor in your jurisdiction before investing your money.

(This article was originally published on 20 December 2024)

Effective communication with artificial intelligence (AI) models starts with crafting clear and concise prompts. When done well, this ensures that AI delivers precise and relevant outputs, saving you time and enhancing its value in your workflow.

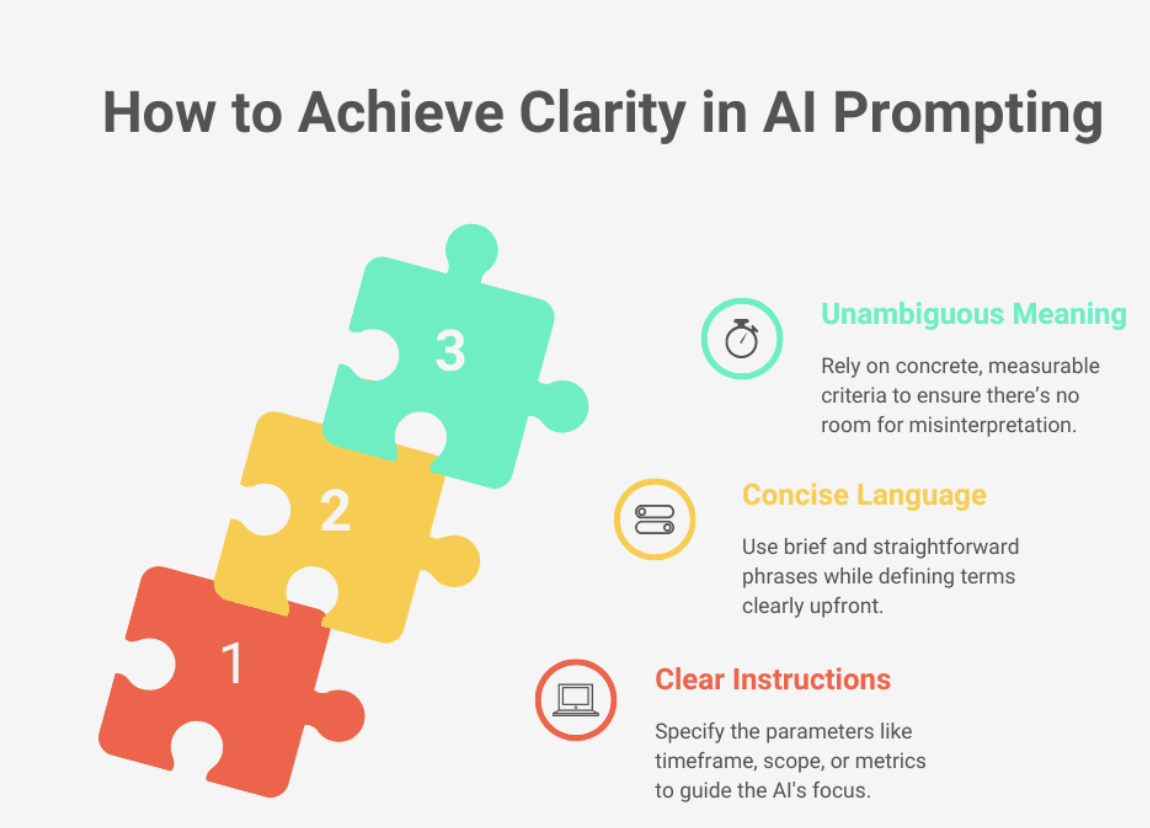

In our previous newsletters, we explored the importance of providing context and assigning roles as essential components of robust AI prompts. Today, we focus on clarity, i.e., how using precise and specific language significantly boosts AI’s effectiveness in investment research and analysis.

Why Clarity Matters

Clear prompts prevent vague or irrelevant results. By using specific and unambiguous language, you help AI understand exactly what you’re asking for. Here’s how to achieve this:

· Clear Instructions: Specify the parameters like timeframe, scope, or metrics to guide the AI model's focus.

· Concise Language: Use brief and straightforward phrases while defining terms clearly upfront.

· Unambiguous Meaning: Rely on concrete, measurable criteria to ensure there’s no room for misinterpretation.

The more precise your prompt, the better tailored the AI output will be to your needs. Let’s look at two examples to illustrate this:

Example 1: Emerging Market Fixed Income Strategy

Let us first look at a potentially ineffective prompt:

Ineffective Prompt:

"Analyze emerging market bonds for investment opportunities."

Why It’s Ineffective:

Lacks Specificity: Doesn’t mention the type of bonds, countries, or criteria.

No Timeframe: Analysis is open-ended.

Unclear Deliverables: Offers no guidance on what information or insights are needed.

Now let us move on to an improved version of this prompt:

Clear Prompt:

Perform a strategic analysis of emerging market sovereign bonds, focusing on three BB+ rated countries between 2022 and 2024. Include:

Key Metrics:

· Current sovereign bond yields.

· Macroeconomic stability indicators (e.g., GDP growth, inflation rates).

· Potential geopolitical or economic risks.

· Currency valuation trends.

Deliverables:

· A 12-month economic outlook for each country.

· Comparative analysis with regional peers.

· Key investment triggers.

· References from reliable sources like the IMF, World Bank, or Bloomberg (please list the references cited).

Exclusions:

· Countries with significant political instability.

· Extreme currency volatility.

· Recent debt restructuring.

Example 2: Performance of U.S. Tech Companies

Let us now look at another prompt example.

Ineffective Prompt:

"Tell me about the performance of tech companies."

Why It’s Ineffective:

Too Broad: Doesn’t specify which companies or what aspects of performance to analyze.

No Timeframe: Leaves the request open-ended.

Unclear Scope: Offers no direction for the analysis.

Clear Prompt:

Provide a detailed analysis of the quarterly revenue growth and profit margins for the top five publicly traded U.S. tech companies—Apple, Microsoft, Alphabet, Amazon, and Meta—for Q3 2024. Include:

· Notable trends.

· Year-over-year performance comparisons.

· Potential future implications.

Please provide references where applicable.

Why This Prompt Works:

Scope: Focuses on five named U.S. tech companies.

Metrics: Specifies revenue growth and profit margins.

Timeframe: Q3 2024, with year-over-year comparisons.

Actionable Outcome: Highlights trends and implications.

Key Takeaway

Clarity in AI prompts ensures precise, actionable responses. Clear prompts define the scope, metrics, and desired outcomes, while vague prompts result in broad or irrelevant outputs. By applying these principles, you can maximize the value of AI in your investment research and analysis.

Reflecting on U.S. Financial Markets in 2024

Using AI Prompts to Research How 2024 Shaped Investment Opportunities Across Sectors

(Please add our email address to your contact list so that the next newsletter goes to your Inbox folder: InvestmentWriterAI@InvestmentWriterAI.com)

This blog post is for educational purposes only. It does not offer any financial advice or investment recommendation. Please contact a registered financial advisor in your jurisdiction before investing your money.

(This article was originally published on 15 December 2024)

As 2024 nears its end, let’s step back and assess how U.S. financial markets have performed year-to-date (YTD). Today’s newsletter will introduce artificial intelligence (AI) prompts that can help you resarch market trends and sector performances to deepen your understanding of the year’s financial narrative.

Here’re several short prompt examples to get you started in your research:

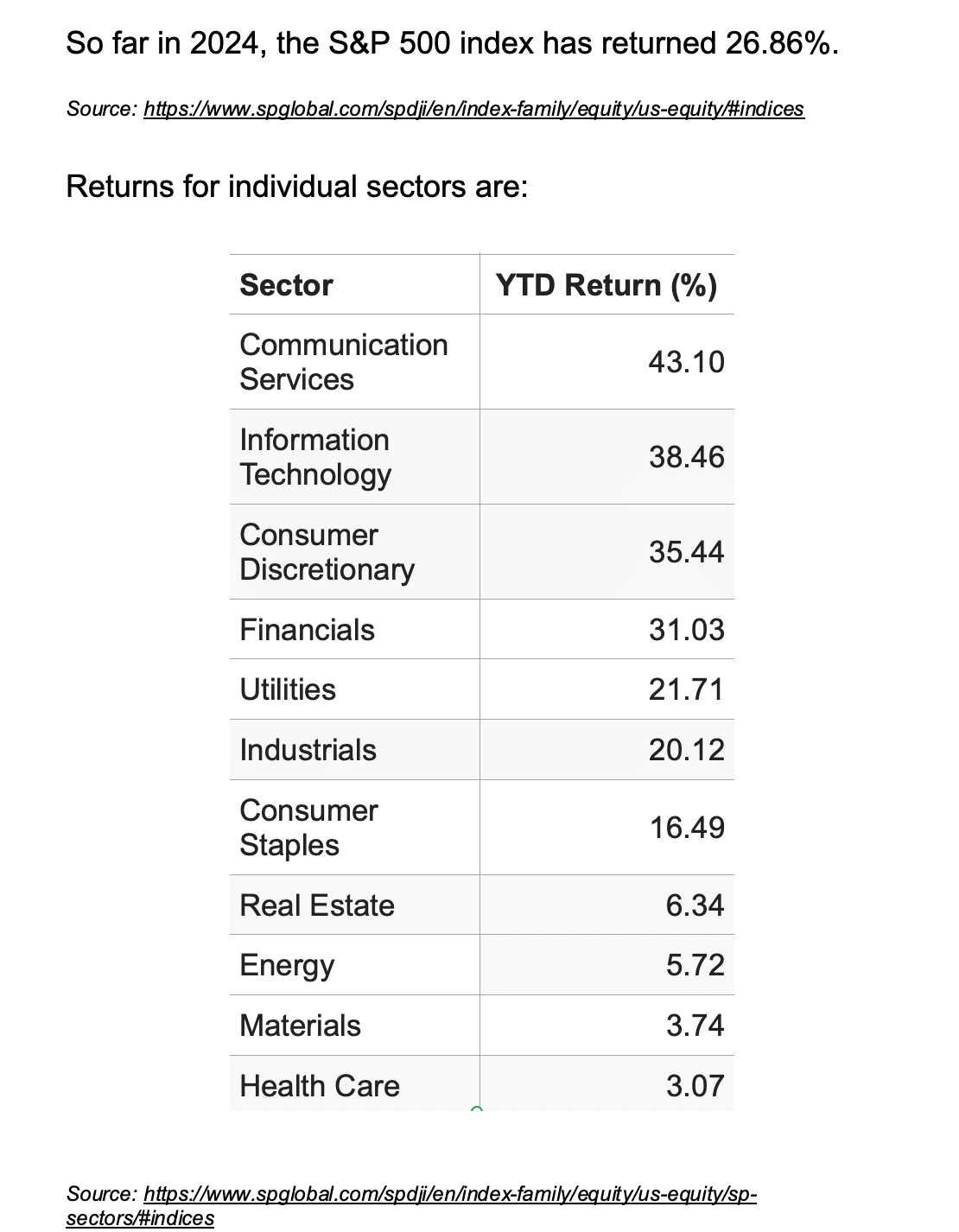

Now here are the YTD returns for the S&P 500 Index as well as its 11 sectors.

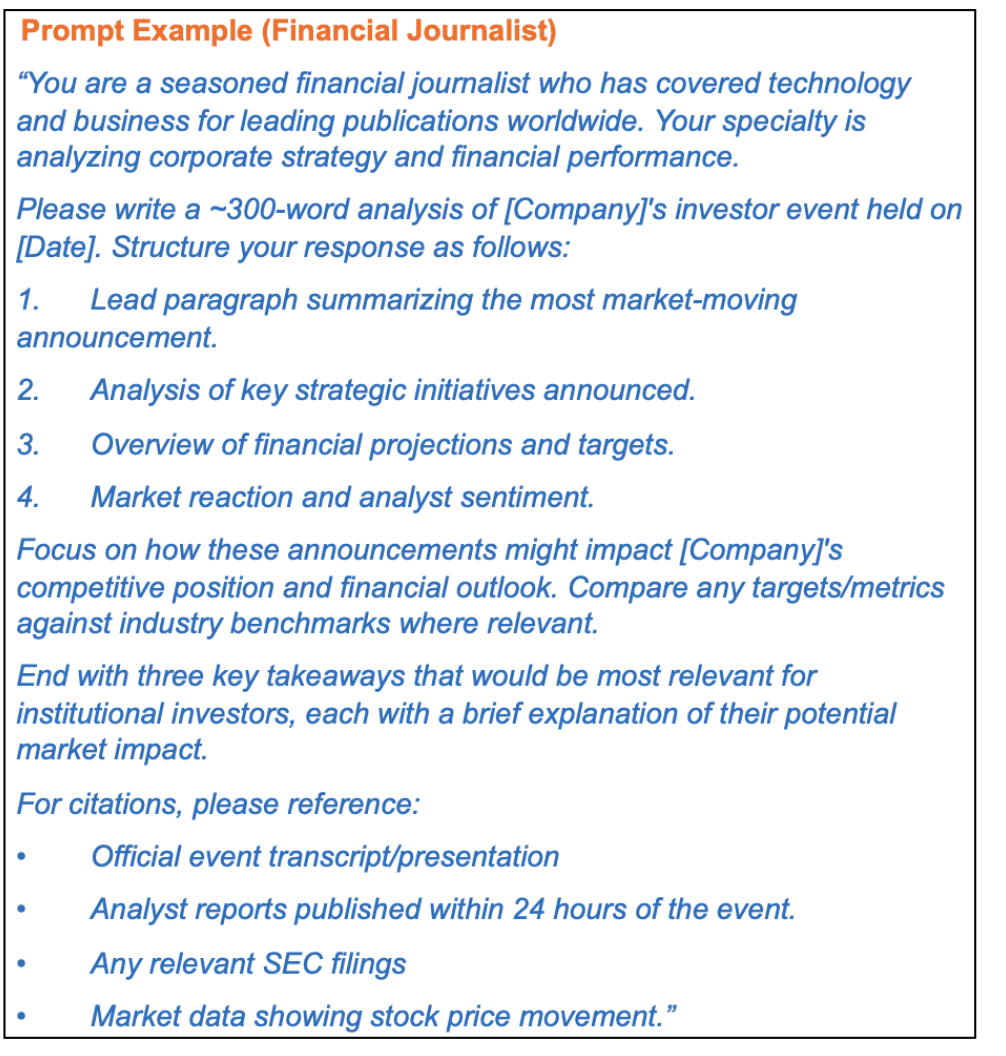

Roles in AI Prompts

Assigning Jobs to LLMs in Investment Research & Financial Analysis

(Please add our email address to your contact list so that the next newsletter goes to your Inbox folder: InvestmentWriterAI@InvestmentWriterAI.com)

This blog post is for educational purposes only. It does not offer any financial advice or investment recommendation. Please contact a registered financial advisor in your jurisdiction before investing your money.

(This article was originally published on11 December 2024)

Developing effective artificial intelligence (AI) prompts isn’t just about asking questions—it’s about guiding the AI with clear instructions and perspectives. This strategy enhances the precision and relevance of the output, making it an essential technique for leveraging AI effectively.

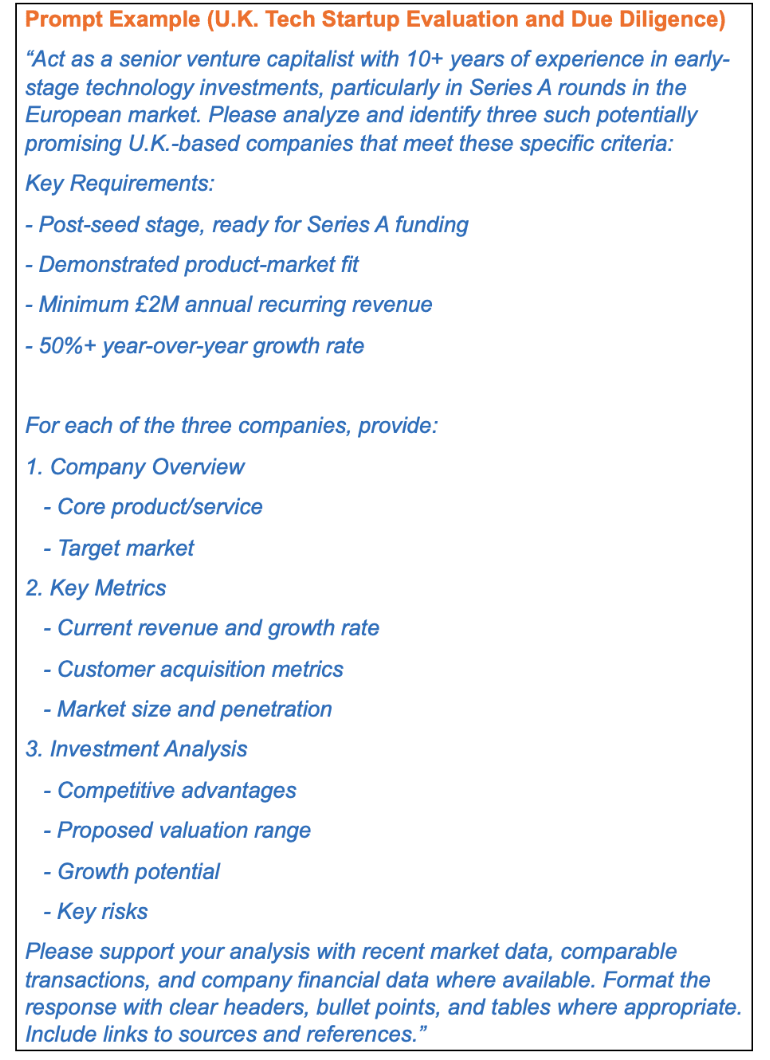

In our previous newsletter, we explored the importance of context as a key component of a robust AI prompt. Today, we turn our focus to “Roles” and how assigning them can boost the effectiveness of AI in investment research and analysis.

Assigning a specific role, such as “equity analyst” or “portfolio manager,” provides a focused framework for the AI to interpret tasks. This approach can help control the style, tone, and accuracy of the output. It also makes it easier to tailor the result to different contexts or audiences, improving their overall relevance.

By defining roles, you, as the user, essentially give the AI a persona that influences how it processes information and formulates responses. For instance, an “equity analyst” might prioritize financial metrics, industry trends, and valuation techniques, while a “portfolio manager” might focus on asset allocation, risk management, and diversification strategies.

This role-based approach not only refines the AI's focus but also ensures that the output aligns more closely with the expectations and objectives of the task at hand. It’s a simple yet powerful way to enhance the relevance and depth of AI-generated insights.

Here are three examples that demonstrate the importance of assigning roles in AI prompting:

Context in AI Prompts

Providing Adequate Background Information

(Please add our email address to your contact list so that the next newsletter goes to your Inbox folder: InvestmentWriterAI@InvestmentWriterAI.com)

This blog post is for educational purposes only. It does not offer any financial advice or investment recommendation. Please contact a registered financial advisor in your jurisdiction before investing your money.

(This article was originally published on 8 December 2024)

Crafting strong artificial intelligence (AI) prompts involves understanding the specific needs of the task, anticipating the nuances of the data, and framing the prompt in a way that the AI model can interpret with minimal misdirection. Even small changes in wording can have a significant impact on the quality of the output, making prompt crafting a key skill for leveraging AI effectively.

In our previous newsletter, we introduced core components of a robust prompt. Today, we discuss “Context,” especially as it relates to investment research and analysis.

Context frames the problem for the Large Language Model (LLM). By providing sufficient information, you, as the user, help the AI platform better understand the landscape in which it is operating, which reduces the chances of generating misaligned or irrelevant outputs. Without proper context, the AI model may produce results that don't consider key factors like market conditions, economic indicators, or specific business scenarios.

Thus, offering the AI a well-defined scenario or background information enhances its ability to deliver insights that align with your objectives. Providing necessary background information helps the AI model grasp the nuances of the request. This can include details about the subject matter, the intended audience, or any specific constraints. It is also important to understand the specific strengths and capabilities of the AI system you are working with.

Different AI models excel in various areas, such as language generation or data analysis. By leveraging these strengths, you can create prompts that maximize the AI's potential and produce high-quality response. Here’re two examples that highlight the importance of context in prompting:

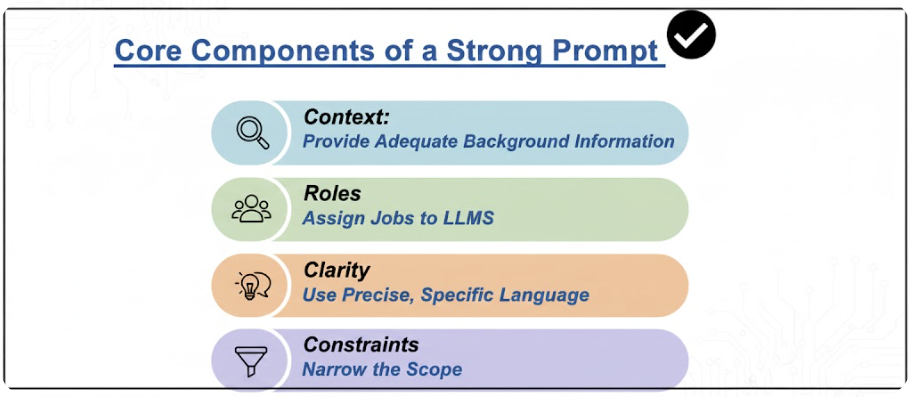

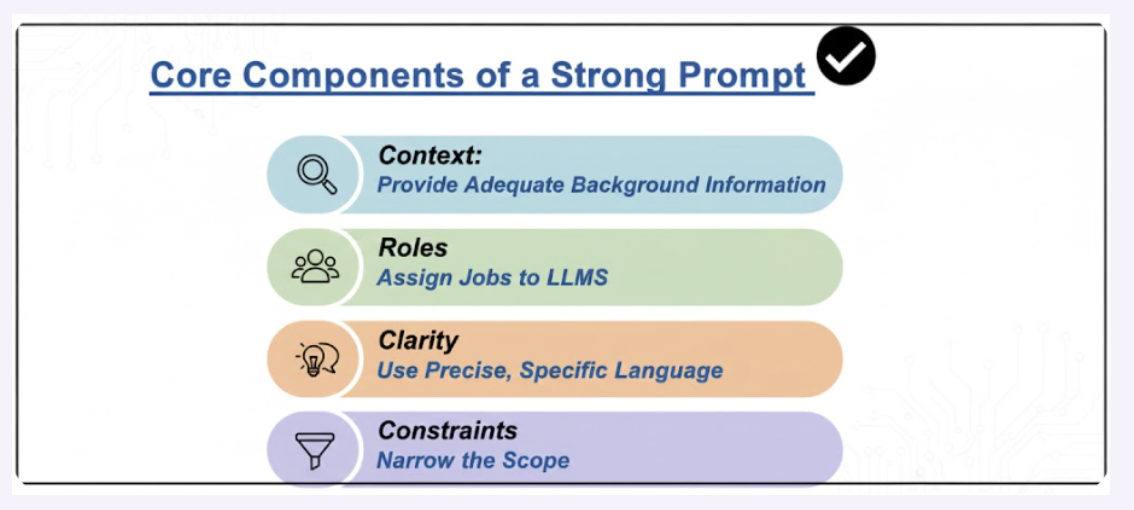

AI Prompting – Best Practices

Core Components of an Effective AI Prompt

(Please add our email address to your contact list so that the next newsletter goes to your Inbox folder: InvestmentWriterAI@InvestmentWriterAI.com)

This blog post is for educational purposes only. It does not offer any financial advice or investment recommendation. Please contact a registered financial advisor in your jurisdiction before investing your money.

(This article was originally published on 7 December 2024)

In the context of artificial intelligence (AI), a prompt is more than just a question or command. It is the starting point of interaction between a human and a machine. A prompt is a specific instruction designed to guide a Large Language Model (LLM) or another AI system in generating a relevant response or performing a particular action. Essentially, it bridges human intention with AI capabilities by directing the AI’s reasoning process.

By carefully designing prompts, users can transform overwhelming amounts of information into clear, strategic recommendations that support better decision-making. Whether it is forecasting market trends, identifying investment opportunities, or managing risk, prompts serve as a critical tool in navigating the financial landscape.

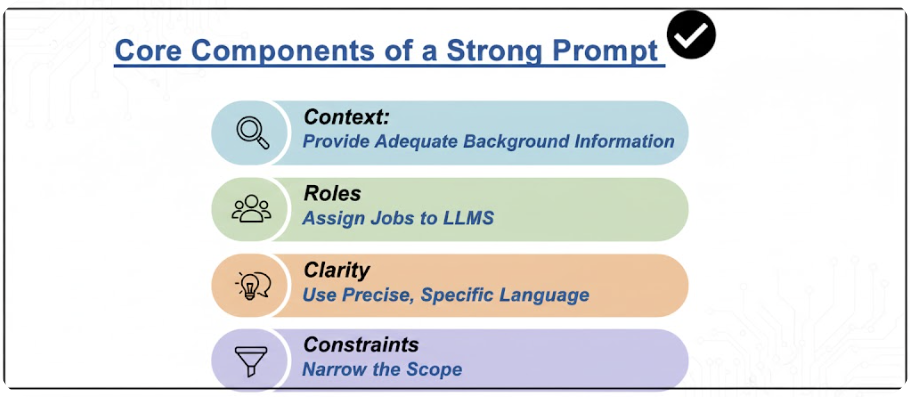

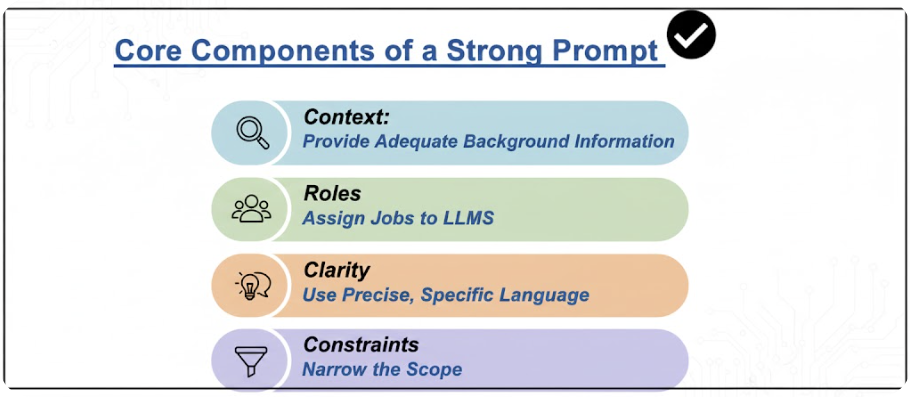

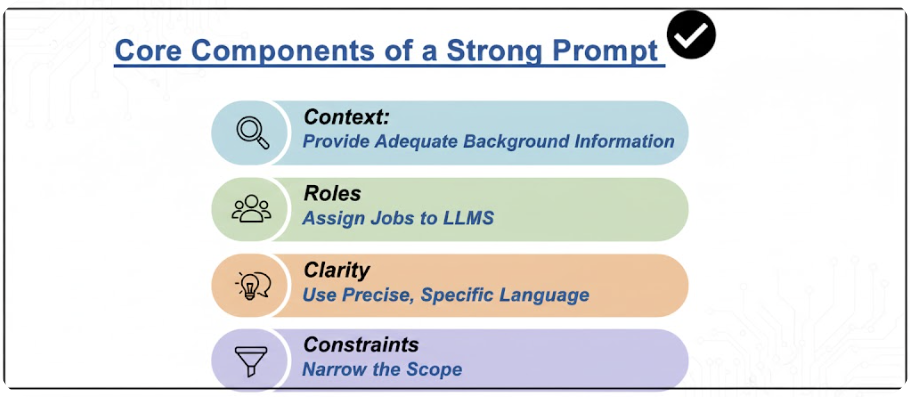

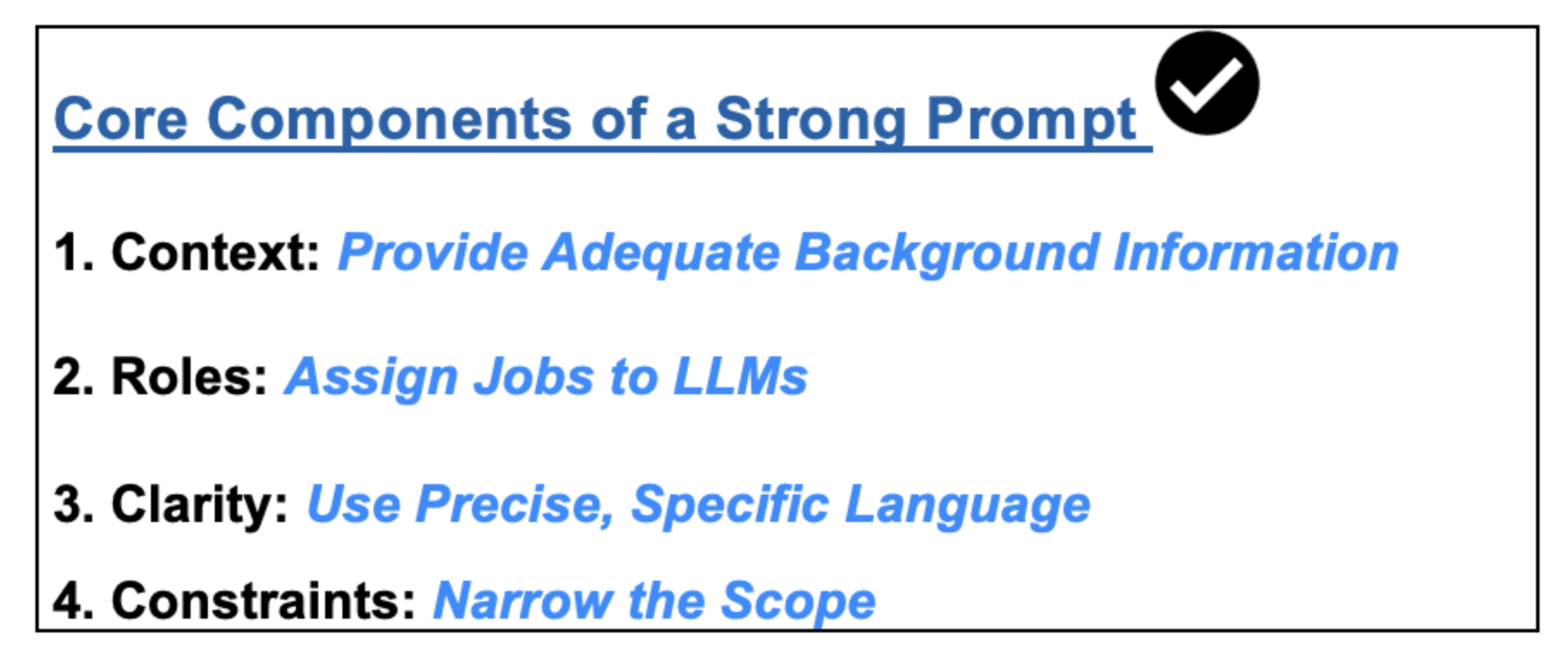

Core Components of an Effective AI Prompt

Crafting strong AI prompts is both an art and a science. A well-constructed prompt maximizes the AI model’s ability to provide actionable insights by eliminating ambiguity and ensuring clarity. Robust prompts should be precise, contextually relevant, and outcome-focused to guide the AI platform in delivering optimal results.

The process involves understanding the specific needs of the task, anticipating the nuances of the data, and framing the prompt in a way that the AI model can interpret with minimal misdirection. Even small changes in wording can have a significant impact on the quality of the output, making prompt crafting a key skill for leveraging AI effectively.

Today, we will briefly name the core components of robust prompts. In the next newsletter, we will discuss these components in depth and explore how they can be applied in real-world investment analysis.

AI-Powered Investment Research: The Future of Finance

Unleashing the Power of AI in Finance!

This blog post is for educational purposes only. It does not offer any financial advice or investment recommendation. Please contact a registered financial advisor in your jurisdiction before investing your money.

(This article was originally published on 3 December 2024)

Welcome to the world of artificial intelligence (AI)–powered investment research. This revolutionary approach leverages artificial intelligence to help analyze market trends, research market developments, create content, potentially predict future movements, and provide actionable insights for investors.

Using either Large Language Models (LLMs) or finance-specific AI models is fast becoming a game-changer in the financial world, offering a new level of precision and efficiency in investment research, analysis, and decision-making.

The Power of AI in Investment Research

AI is transforming the way we approach investment research. By processing vast amounts of data at lightning speed, AI can identify patterns and trends that would be quite difficult or time-consuming for a human analyst to detect.

This can allow for more accurate research and predictions, and even smarter investment decisions. From predictive analytics to risk assessment, AI is revolutionizing every aspect of investment research.

AI Prompting in Investment Research and Finance

Our newsletters focus on how to write strong generative (gen) AI prompts with a specific emphasis on investment management. This discussion is intended for investment professionals and investors looking to leverage AI prompting effectively.

AI prompts are specific instructions guiding AI models to generate relevant responses or perform specific actions. Well-crafted prompts are crucial in harnessing AI capabilities for a given task. The effectiveness of a prompt lies in its clarity, specificity, and relevance to the task at hand.

By mastering AI prompts and deeply understanding their ethical implications, investors can harness the full potential of AI while navigating the complexities of modern financial markets responsibly. This balanced approach ensures that AI is leveraged not just as a tool for profit, but as a means to create a more efficient, equitable, and sustainable financial future.

As we embark on this journey through the world of AI-powered investment analysis, prepare to unlock new possibilities, challenge traditional paradigms, and reshape your approach to financial decision-making. The future of investment is here, and it is driven by AI.

Ethical Considerations and Responsible Use of AI in Finance

While the capabilities of AI in investments and finance are undoubtedly powerful, they also raise important ethical questions that demand attention.

The increasing reliance on AI in investment analysis can introduce subtle biases, as AI models are inherently limited by the data on which they are trained. This limitation can lead to unintended consequences, potentially reinforcing existing biases in financial markets or creating new ones.

Therefore, it is crucial to approach AI-driven analysis with a sense of responsibility and maintain rigorous human oversight. Ethical considerations in AI-driven investment strategies include:

The importance of transparency in AI-driven decision-making

The need for accountability in the use of LLMs

The role of ethical decision-making in the AI-driven investment landscape

Strategies for mitigating AI bias in financial models

About Us

We are a group of seasoned investment professionals, researchers, and writers with a passion for technology. Since early 2023, we have been using our expertise to help investment professionals and investors navigate the evolving landscape.

AI-powered investment research is more than just a trend — it is the future of finance. As we continue to harness the power of AI, we can look forward to a new era of investment research that is more efficient, accurate, and profitable than ever before.

Let’s explore this vast yet exciting topic together.

LLMs in Investment Management & Finance

General-Purpose LLMs versus Finance-Specific LLMs

This blog post is for educational purposes only. It does not offer any financial advice or investment recommendation. Please contact a registered financial advisor in your jurisdiction before investing your money.

(This article was originally published on 1 December 2024)

Large Language Models (LLMs) are artificial intelligence (AI) models trained on massive datasets encompassing a wide variety of topics. These models can understand and generate human-like text. They are designed to handle a broad spectrum of natural language processing tasks, such as translation, summarization, sentiment analysis, and content generation.

One of the standout features of LLMs is their versatility. Since they are trained on diverse datasets, they can adapt to different industries, including investment management. In finance, LLMs can assist both professionals and individual investors by providing deeper insights into market conditions, company reports, and investment risks.

General-purpose LLMs are generally more suited for broad, adaptable language tasks. They are trained on a vast array of content, from literature to news articles, making them highly flexible but not deeply specialized.

On the other hand, finance-specific LLMs are specially designed to tackle the unique challenges posed by financial language and data. These models can be trained on more targeted data, such as financial reports, market analysis, regulatory filings, and sector-specific news articles. As a result, they may be better equipped to perform tasks such as sentiment analysis in earnings reports, credit risk assessments, and forecasting stock price movements. Their deeper understanding of financial vocabulary and context may make them more suitable for precise financial analysis.

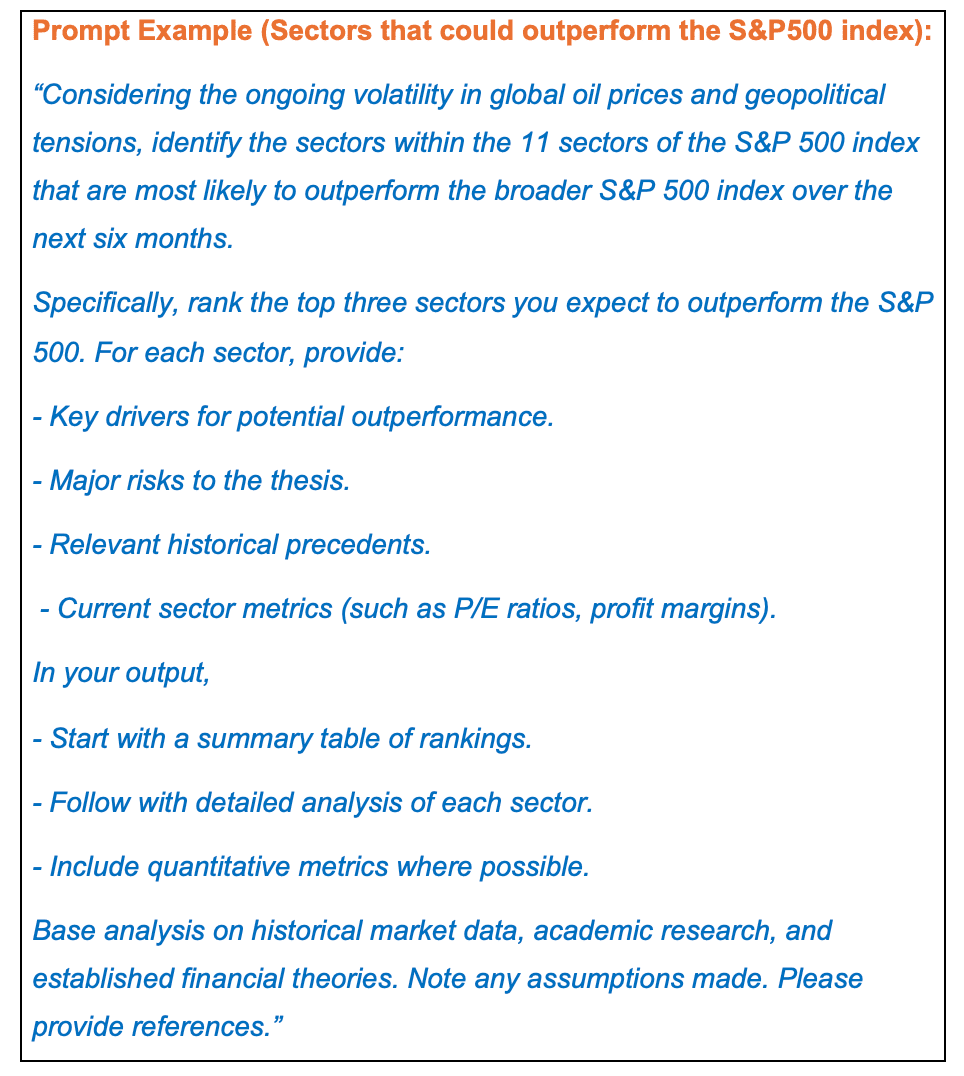

Prompt Example

“Considering the ongoing volatility in global oil prices and geopolitical tensions, identify the sectors within the 11 sectors of the S&P 500 index that are most likely to outperform the broader S&P 500 index over the next six months. Please provide references.”

What Type of LLM to Use

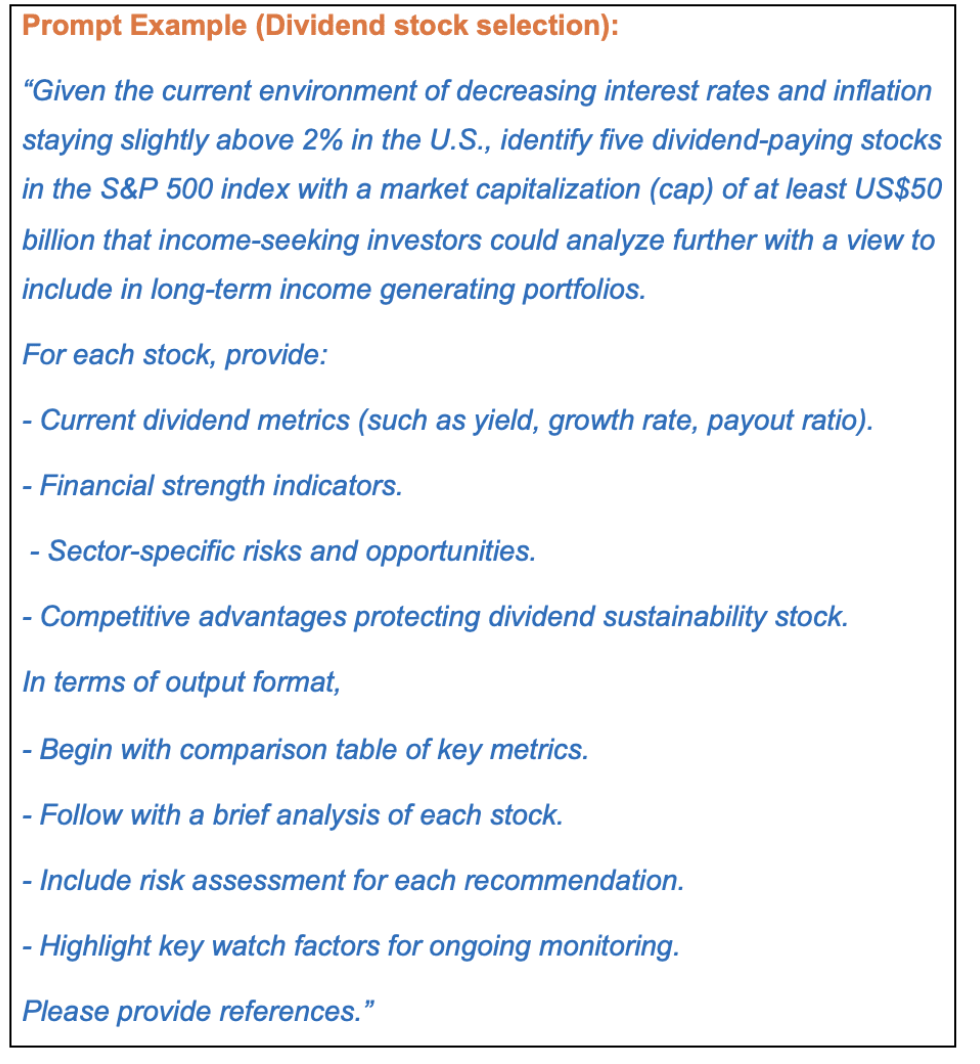

The choice between using a general-purpose LLM or a finance-specific model largely depends on the task at hand.

General-purpose LLMs are well-suited for tasks that require a broader understanding of language and are adaptable across various industries. However, when the task requires in-depth financial expertise—such as analyzing intricate financial statements or assessing the risk factors in credit markets—finance-specific LLMs may provide a more accurate and reliable solution.

These models are tailored to produce more precise outputs in finance-related queries, making them an increasingly valuable tool for specialized financial applications.

In summary, while general-purpose LLMs offer breadth and adaptability, finance-specific AI models may bring precision and a deeper understanding of the financial landscape, making them a better choice for complex financial tasks.

Prompt Example

“Given the current environment of decreasing interest rates and inflation staying slightly above 2% in the U.S., identify five dividend-paying stocks in the S&P 500 index that income-seeking investors should analyze further. Please provide references.”

Key principles of value investing

& How to Apply Them to Evaluate the True Market Value of AAPL Stock

This blog post is for educational purposes only. It does not offer any financial advice or investment recommendation. Please contact a registered financial advisor in your jurisdiction before investing your money.

To understand and apply the key principles of value investing to evaluate the true market value of Apple Inc. (AAPL), let us consider several steps to follow:

Key Principles of Value Investing

Seek Intrinsic Value

Principle: Identify stocks priced below their intrinsic value by analyzing financial statements, competitive advantages, and future cash flows.

Application to AAPL: Examine Apple's financials, such as its income statement and balance sheet, to assess its earnings, revenue growth, and cash flow. Use valuation metrics like the price-to-earnings (P/E) ratio and price-to-book (P/B) ratio to gauge its market valuation against its intrinsic worth.

Margin of Safety

Principle: Purchase stocks at a discount to their intrinsic value to protect against market volatility.

Application to AAPL: Determine Apple's intrinsic value through discounted cash flow analysis. If AAPL's intrinsic value is estimated at $250 per share and it's trading at $226.80, this provides a margin of safety.

Long-Term Perspective

Principle: Hold investments for the long term to allow for compounding and appreciation.

Application to AAPL: Consider Apple's long-term growth potential, driven by innovation and market expansion, and be prepared to hold the stock through short-term market fluctuations.

Contrarian Thinking

Principle: Invest against market trends when stocks are undervalued due to negative sentiment.

Application to AAPL: If market sentiment is negative due to temporary setbacks, a contrarian investor might see this as an opportunity to buy AAPL at a lower price, anticipating a recovery.

Continuous Learning and Adaptation

Principle: Stay informed about market changes and adapt strategies accordingly.

Application to AAPL: Keep abreast of technological advancements and market trends affecting Apple, such as AI and 5G, to refine your investment thesis.

Understand Risks and Opportunities

Principle: Evaluate both risks and opportunities to make informed decisions.

Application to AAPL: Assess risks like competition and regulatory challenges, and opportunities such as new product launches and market expansion.

Bottom-Up Valuation Approach

Principle: Conduct a detailed analysis of a company's fundamentals from the ground up.

Application to AAPL: Analyze Apple's financial statements, management quality, and competitive position to understand its intrinsic value.

Invest in Companies You Understand

Principle: Focus on businesses you comprehend to make informed investment choices.

Application to AAPL: Understand Apple's business model, product lines, and revenue streams to evaluate its market value accurately.

Buy Businesses, Not Stocks

Principle: Focus on the company's fundamentals rather than stock price movements.

Application to AAPL: Evaluate Apple's business fundamentals, such as its innovation pipeline and market share, rather than short-term stock price fluctuations.

Evaluating AAPL's True Market Value

Financial Analysis: Review Apple's latest financial filings, such as its 10-Q, to understand its revenue, profit margins, and cash flow. Apple's recent quarterly report shows strong operating income and cash flow generation, which are critical for intrinsic value assessment.

Valuation Metrics: Use valuation ratios like P/E and P/B to compare Apple's market price with its intrinsic value. As of the latest data, Apple's P/E ratio is around 33.9x, which can be compared to industry peers to assess relative value.

Market Position: Consider Apple's competitive advantages, such as brand strength and innovation capabilities, which contribute to its intrinsic value.

By applying these principles, you can better evaluate AAPL's true market value and make informed investment decisions. Remember, value investing requires patience and a long-term perspective to realize potential gains.

Stocks We’re Watching In October 2024

This blog post is for educational purposes only. It does not offer any financial advice or investment recommendation. Please contact a registered financial advisor in your jurisdiction before investing your money.

Choosing a good stock to buy involves careful consideration of various factors, including market trends, company performance, and your personal investment goals. Here are some stocks we are watching in October 2024 based on the latest data:

Tech Sector Opportunities:

Nvidia (NVDA): Nvidia is a leader in the AI and semiconductor industry, benefiting from the growing demand for AI chips. Its strong market position and innovation make it a compelling choice for growth investors. The company's market cap is substantial, reflecting its influence and potential in the tech sector.

Amazon (AMZN): Known for its diverse revenue streams, Amazon continues to dominate e-commerce and cloud computing. Its market dominance and innovative strategies position it well for long-term growth.

Growth Stocks:

Taiwan Semiconductor Manufacturing (TSM): As a key player in the semiconductor industry, TSM is poised to benefit from the AI and tech boom. Its strategic importance in the global supply chain makes it a strong candidate for growth-focused portfolios.

Meta Platforms (META): With a focus on virtual reality and social media, Meta is investing heavily in future technologies. Its growth potential is significant, especially as it explores new digital frontiers.

Value and Stability:

Pfizer (PFE): Trading below its fair value, Pfizer offers a stable investment with a diverse drug portfolio. Its potential for steady growth and strong cash flow make it attractive for value investors.

Estee Lauder (EL): Known for its strong brand and predictable cash flow, Estee Lauder is trading below its fair value, offering a potential upside for investors seeking stability and growth.

Dividend and Long-Term Investments:

Enterprise Products Partners (EPD): This company offers a high dividend yield and a diversified pipeline network, making it a solid choice for income-focused investors looking for long-term stability.

Microsoft (MSFT): With a strong performance record and a focus on cloud computing and AI, Microsoft remains a top choice for long-term investors seeking both growth and dividends.

Considerations:

Risk Tolerance: Assess your risk tolerance before investing. High-growth stocks like Nvidia and Amazon may offer significant returns but come with higher volatility.

Market Conditions: Stay informed about market trends and economic indicators that could impact stock performance.

Before making any investment decisions, it's crucial to conduct thorough research and consider consulting with a financial advisor to align your choices with your financial goals and risk profile.

Key factors to consider when selecting a stock to buy

This blog post is for educational purposes only. It does not offer any financial advice or investment recommendation. Please contact a registered financial advisor in your jurisdiction before investing your money.

When selecting a stock to buy, it's crucial to consider a comprehensive set of factors to ensure a well-informed investment decision. Here are the key considerations:

Fundamental Analysis:

Earnings and Revenue Growth: Look for companies with a strong track record of revenue and earnings per share (EPS) growth. Consistent growth indicates a healthy business model and potential for future profitability.

Financial Health: Assess the company's balance sheet for financial stability. Key metrics include low debt levels, strong cash flow, and a healthy current ratio, which indicates the company's ability to cover short-term liabilities.

Valuation Metrics: Evaluate the price-to-earnings (P/E) ratio and compare it to industry peers. A lower P/E might suggest undervaluation, but it's important to consider the context of the industry and growth prospects.

Dividend Yield: Consider the dividend yield as a sign of income potential. However, be cautious of yields that are unusually high, as they may indicate financial distress.

Industry and Market Position:

Industry Trends: Understand the broader industry dynamics and how they might impact the company. Look for sectors with positive growth trends and innovation.

Competitive Advantage: Determine if the company has a sustainable competitive edge, such as a strong brand, proprietary technology, or cost advantages, which can protect its market position.

Management Quality:

Leadership Integrity: Evaluate the experience and track record of the management team. Strong leadership is crucial for strategic decision-making and navigating market challenges.

Technical Analysis:

Chart Patterns: Use technical analysis to identify trends and potential entry points. This includes analyzing moving averages, support and resistance levels, and other indicators.

Volatility and Risk: Consider the stock's beta, which measures its volatility relative to the market. A higher beta indicates more risk, which might be suitable for aggressive investors.

Screening Tools:

Stock Screeners: Utilize tools to filter stocks based on criteria such as market capitalization, sector, and financial ratios. This helps narrow down choices to those that meet your investment strategy.

Qualitative Research:

Business Model: Understand the company's operations, products, and revenue streams. This includes knowing its competitive landscape and customer base.

News and Developments: Stay updated with the latest news, earnings reports, and analyst opinions to gauge market sentiment and potential impacts on the stock.

Diversification:

Portfolio Balance: Ensure your portfolio is diversified across different sectors and asset classes to mitigate risk. Diversification helps protect against sector-specific downturns.

By integrating these factors into your analysis, you can make more informed and strategic investment decisions. Always consider consulting with a financial advisor to align your choices with your financial goals and risk tolerance.

Understanding the Divide: US Growth vs Value Stocks in 2024

This blog post is for educational purposes only. It does not offer any financial advice or investment recommendation. Please contact a registered financial advisor in your jurisdiction before investing your money.

As investors navigate the US stock market in 2024, the distinction between growth and value stocks remains a crucial consideration for portfolio construction. While both categories offer potential for returns, they possess distinct characteristics and tend to perform differently under varying economic conditions.

Defining Growth and Value Stocks

Growth stocks are shares of companies expected to grow at an above-average rate compared to other firms in the market. These companies typically reinvest profits to fuel expansion, innovation, and market dominance rather than paying dividends.Value Stocks are shares of companies that appear to be undervalued based on fundamental analysis. These firms often have stable earnings, pay dividends, and trade at lower price-to-earnings (P/E) ratios compared to the broader market.

Key Characteristics

Growth Stocks:

High revenue and earnings growth rates

Elevated price-to-earnings (P/E) ratios

Focus on reinvestment rather than dividends

Often found in innovative or rapidly expanding sectors

Higher volatility and potential for significant price swings

Value Stocks:

Lower P/E ratios and price-to-book (P/B) ratios

Stable, often mature businesses

Regular dividend payments

Found in established industries

Generally lower volatility compared to growth stocks

Examples of US Growth and Value Stocks in 2024

Growth Stock Examples:

NVIDIA Corporation (NASDAQ: NVDA)

Sector: Technology (Semiconductors)

Known for: Leading AI chip technology

Key Metrics: High P/E ratio, strong revenue growth

Shopify Inc. (NYSE: SHOP)

Sector: Technology (E-commerce)

Known for: Innovative e-commerce platform

Key Metrics: Rapid revenue growth, reinvestment in expansion

Tesla, Inc. (NASDAQ: TSLA)

Sector: Consumer Cyclical (Automotive)

Known for: Electric vehicles and renewable energy

Key Metrics: High P/E ratio, focus on innovation and market expansion

Value Stock Examples:

JPMorgan Chase & Co. (NYSE: JPM)

Sector: Financial Services

Known for: Stable banking operations and dividend payments

Key Metrics: Lower P/E ratio, consistent dividend yield

Procter & Gamble Company (NYSE: PG)

Sector: Consumer Defensive

Known for: Diverse portfolio of consumer goods

Key Metrics: Steady earnings, long history of dividend increases

ExxonMobil Corporation (NYSE: XOM)

Sector: Energy

Known for: Integrated oil and gas operations

Key Metrics: Lower P/E ratio, high dividend yield

Performance Trends and Market Dynamics

Historically, growth and value stocks have exhibited different performance patterns:

Growth Stock Performance: Growth stocks have outperformed in recent years, particularly during periods of low interest rates and economic expansion. The technology sector, a haven for growth stocks, has been a significant driver of US market returns.

Value Stock Resurgence: As of 2024, value stocks have shown signs of a comeback, partly due to rising interest rates and inflation concerns. Sectors like financials and energy, typically associated with value investing, have seen increased investor interest.

Factors Influencing Growth vs Value Performance

Interest Rates: Rising rates tend to favor value stocks, as they can negatively impact the future earnings potential of growth companies.

Economic Cycles: Growth stocks often outperform during economic expansions, while value stocks may be more resilient during downturns.

Sector Rotation: Investor sentiment can shift between sectors, impacting the relative performance of growth and value stocks.

Technological Disruption: Rapid technological changes can create opportunities for growth stocks while potentially challenging traditional value sectors.

Investment Strategies

Investors often adopt different strategies when approaching growth and value stocks:

Growth Investing: Focus on companies with strong revenue and earnings growth potential, often accepting higher valuations and volatility.

Value Investing: Seek undervalued companies with strong fundamentals, aiming for capital appreciation and income through dividends.

Blended Approach: Many investors and fund managers combine both growth and value stocks to achieve diversification and balance within their portfolios.

Conclusion

The distinction between growth and value stocks remains relevant in the 2024 US market landscape. While growth stocks have dominated headlines in recent years, value stocks have shown resilience and potential for outperformance in certain economic conditions. Savvy investors recognize the importance of understanding these different investment styles and how they can complement each other within a well-diversified portfolio.As market conditions evolve, the relative attractiveness of growth and value stocks may shift. Investors should remain vigilant, regularly reassessing their investment theses and adjusting their portfolios to align with their financial goals and risk tolerance. By understanding the nuances of growth and value investing, investors can make more informed decisions in navigating the complex and ever-changing US stock market.

Cyclical vs Non-Cyclical Stocks: Understanding Market Dynamics in 2024

This blog post is for educational purposes only. It does not offer any financial advice or investment recommendation. Please contact a registered financial advisor in your jurisdiction before investing your money.

As we navigate the complex economic landscape of 2024, understanding the distinction between cyclical and non-cyclical stocks remains crucial for investors seeking to build resilient portfolios.

Economic Cycles and Stock Performance

Economies typically progress through four stages: expansion, peak, contraction, and trough. These fluctuations significantly impact stock performance, particularly for cyclical stocks.

Characteristics of Cyclical Stocks

Cyclical stocks are equities of companies whose fortunes are closely tied to economic cycles. These businesses tend to thrive during economic expansions and struggle during downturns.

High Beta: Cyclical stocks often have beta values exceeding 1, indicating higher volatility than the broader market.

Volatile Earnings: Earnings per share (EPS) for cyclical stocks can fluctuate dramatically with economic conditions.

Lower P/E Ratios: Due to earnings volatility, cyclical stocks often trade at lower price-to-earnings ratios.

Key Sectors for Cyclical Stocks in 2024

Automotive: Companies like General Motors (NYSE:GM) and AutoZone (NYSE:AZO).

Banking: Capital One Financial (NYSE:COF) and Wells Fargo (NYSE:WFC).

Technology: Qualcomm (NASDAQ:QCOM) and Nvidia (NASDAQ:NVDA).

Travel and Leisure: Boeing (NYSE:BA) and Expedia Group (NASDAQ:EXPE).

Non-Cyclical Stocks: Stability Amid Turbulence

Non-cyclical or defensive stocks represent companies whose products and services remain in demand regardless of economic conditions.

Characteristics of Non-Cyclical Stocks

Stable Earnings: These companies typically maintain consistent profitability across economic cycles.

Lower Volatility: Non-cyclical stocks generally exhibit less price volatility.Dividend Payments: Many non-cyclical stocks offer regular dividend payments.

Key Sectors for Non-Cyclical Stocks in 2024

Consumer Staples: Coca-Cola (NYSE:KO) and Procter & Gamble (NYSE:PG).

Healthcare: Johnson & Johnson (NYSE:JNJ) and Merck (NYSE:MRK).

Utilities: American Water Works (NYSE:AWK) and UGI (NYSE:UGI).

Recent Trends and Outlook

As of 2024, several factors are influencing the performance of cyclical and non-cyclical stocks:

Interest Rate Environment: With potential interest rate cuts on the horizon, cyclical stocks may see increased investor interest.

Technological Integration: Traditional cyclical industries are increasingly incorporating technology, blurring the lines between sectors. For example, Cummins, known for truck engines, is now involved in green energy and data center power systems.

Infrastructure Spending: Companies like Nucor (NYSE:NUE) are benefiting from increased government infrastructure spending, which is expected to drive demand over the next decade.

Evolving Consumer Behavior: Post-pandemic shifts in consumer preferences continue to impact both cyclical and non-cyclical sectors, particularly in areas like travel and entertainment.

Building a Balanced Portfolio

Given the distinct characteristics of cyclical and non-cyclical stocks, a well-diversified portfolio typically includes a mix of both. This approach can help investors capitalize on economic growth while maintaining stability during downturns.

As we progress through 2024, the distinction between cyclical and non-cyclical stocks remains a crucial consideration for investors. While cyclical stocks offer the potential for significant gains during economic upswings, non-cyclical stocks provide stability and consistent returns. By understanding these dynamics and staying attuned to evolving market trends, investors can make more informed decisions in their pursuit of long-term financial success.

Understanding Dividend Stocks

This blog post is for educational purposes only. It does not offer any financial advice or investment recommendation. Please contact a registered financial advisor in your jurisdiction before investing your money.

Dividend stocks have long been a cornerstone of income-focused investment strategies. As we move through 2024, these stocks continue to play a crucial role in many investors' portfolios, offering a blend of steady income and potential capital appreciation.

What Are Dividends?

Dividends are distributions of a company's earnings to its shareholders, approved by the board of directors. When a corporation generates profit, it can either reinvest in the business or distribute a portion to shareholders as dividends.

The value of a dividend is typically allocated on a per-share basis. While cash dividends are most common, companies may also issue stock dividends or other forms of property.

For investors, two key metrics to consider are the dividend amount and the dividend yield. The dividend yield is calculated by dividing the annual dividend per share by the stock's current price. For example, a stock priced at $50 with an annual dividend of $2 would have a dividend yield of 4%.

Which Stocks Pay Dividends in 2024?

As of 2024, dividend-paying stocks continue to be predominantly large-cap, well-established companies. Industries known for consistent dividend payments include utilities, financial services, healthcare, and telecommunications.

Dividend Kings and Aristocrats

Dividend Kings, companies that have increased their dividend payments for at least 50 consecutive years, remain a focus for income investors. Some notable Dividend Kings in 2024 include:

Coca-Cola (NYSE:KO)

Procter & Gamble (NYSE:PG)

Johnson & Johnson (NYSE:JNJ)

Dividend Aristocrats, which have increased dividends for at least 25 consecutive years, continue to be popular. Some current Dividend Aristocrats include:

McDonald's (NYSE:MCD)

NextEra Energy (NYSE:NEE)

Exxon Mobil (NYSE:XOM)

Emerging Trends in Dividend Stocks

In 2024, several trends have emerged in the dividend stock landscape:

Technology Sector Dividends: More tech companies are initiating or increasing dividends as they mature, including firms like Microsoft (NASDAQ:MSFT) and Apple (NASDAQ:AAPL).

ESG-Focused Dividend Stocks: Companies with strong environmental, social, and governance (ESG) practices are increasingly attractive to dividend investors.

Global Dividend Opportunities: With varying economic conditions worldwide, international dividend stocks are gaining attention for diversification.

How to Invest in Dividend Stocks in 2024

Investors can approach dividend investing through individual stock selection or by using dividend-focused mutual funds and ETFs.When selecting individual stocks, consider factors such as:

Dividend yield

Payout ratio

Dividend growth history

Company financial health

Several popular dividend-focused ETFs in 2024 include:

Vanguard Dividend Appreciation ETF (NYSE:VIG)

iShares Select Dividend ETF (NASDAQ:DVY)

SPDR S&P Dividend ETF (NYSE:SDY)

Dividend Reinvestment Plans (DRIPs)

Dividend Reinvestment Plans (DRIPs) remain a popular strategy for compounding returns. Many brokerages now offer commission-free DRIP options, making it easier for investors to automatically reinvest their dividends.

Tax Considerations for Dividend Investors

As of 2024, tax treatments for dividends vary by jurisdiction. In many countries, qualified dividends receive preferential tax treatment compared to ordinary income. However, investors should consult with tax professionals for the most current regulations in their area.

The Role of Dividends in Portfolio Strategy

Dividends continue to play a significant role in total return. According to updated data from S&P Global, since 1926, dividends have contributed approximately 33% of the total return for the S&P 500, with capital appreciation accounting for the remaining 67%.

Conclusion

Dividend stocks remain an attractive option for investors seeking income and stability. While the fundamentals of dividend investing remain largely unchanged, evolving market conditions and company practices continue to shape the dividend stock universe. As always, investors should conduct thorough research and consider their individual financial goals when incorporating dividend stocks into their investment strategy.

Understanding Exchange-Traded Funds (ETFs)

This blog post is for educational purposes only. It does not offer any financial advice or investment recommendation. Please contact a registered financial advisor in your jurisdiction before investing your money.

Exchange-traded funds (ETFs) have revolutionised the investment landscape since their introduction in the early 1990s. These versatile investment vehicles offer a unique blend of diversification, flexibility, and cost-effectiveness that has made them increasingly popular among both retail and institutional investors.

What is an ETF?

An ETF is a type of investment fund that holds a basket of securities, which can include stocks, bonds, commodities, currencies, and even cryptocurrency futures. ETF shares represent partial ownership of this portfolio and can be bought or sold on stock exchanges, much like individual stocks

.The first ETF launched in the United States was the SPDR S&P 500 ETF Trust (NYSE:SPY) in 1993, which tracks the performance of the S&P 500 index. Since then, the ETF market has grown exponentially. By 2024, there were over 3,000 ETFs listed in the US, with assets under management exceeding $8 trillion.

How ETFs Work

ETFs are created and regulated by financial authorities such as the Securities and Exchange Commission (SEC) in the United States. The ETF sponsor initially purchases the underlying securities and then sells ETF shares to investors.

Most ETFs are passively managed, meaning they aim to replicate the performance of a specific index. However, actively managed ETFs, where fund managers make discretionary investment decisions, have gained popularity in recent years.One unique aspect of ETFs is their creation and redemption process. Authorised participants can create new ETF shares by depositing a basket of the underlying securities with the fund, or redeem existing shares for the underlying securities. This mechanism helps keep the ETF's market price closely aligned with its net asset value (NAV).

Why Invest in ETFs?

ETFs offer several advantages that have contributed to their growing popularity:

Diversification: ETFs provide exposure to a broad range of securities in a single investment, helping to spread risk.

Cost-effectiveness: Many ETFs, especially those tracking broad market indices, have low expense ratios compared to actively managed mutual funds.

Flexibility: ETFs can be bought and sold throughout the trading day at market prices, offering greater liquidity than traditional mutual funds.

Transparency: Most ETFs disclose their holdings daily, allowing investors to know exactly what they own.

Tax efficiency: Due to their structure, ETFs often generate fewer capital gains distributions than mutual funds, potentially resulting in lower tax liabilities for investors.

Types of ETFs

The ETF universe has expanded to cover a wide range of asset classes, sectors, and investment strategies. Some popular types include:

Equity ETFs: These track stock market indices or specific sectors.

Fixed Income ETFs: These invest in various types of bonds.

Commodity ETFs: These track the price of commodities like gold, oil, or agricultural products.

Currency ETFs: These invest in foreign currencies.

Leveraged and Inverse ETFs: These use derivatives to amplify returns or bet against market movements.

Thematic ETFs: These focus on specific investment themes like artificial intelligence or clean energy.

Recent Trends in ETF Investing

As of late 2024, several trends have emerged in the ETF market:

Growth in Fixed Income ETFs: In the second quarter of 2024, fixed income ETF inflows totaled $68.5 billion, reflecting investors' search for yield in a uncertain interest rate environment

Thematic ETFs: Investors are increasingly drawn to ETFs focused on specific themes or trends. For example, the Schwab Crypto Thematic ETF and the iShares Blockchain and Tech ETF have seen strong performance

ESG Integration: Environmental, Social, and Governance (ESG) factors are becoming more prominent in ETF strategies, with funds like the Xtrackers Net Zero Pathway Paris Aligned US Equity ETF gaining traction

Active ETFs: While passive ETFs still dominate, actively managed ETFs are growing in popularity, offering the potential for outperformance in certain market segments.

Considerations for ETF Investors

While ETFs offer numerous benefits, investors should consider several factors:

Expense Ratios: Even small differences in annual fees can significantly impact long-term returns.

Tracking Error: Some ETFs may not perfectly replicate their benchmark index.

Liquidity: Less popular ETFs may have wider bid-ask spreads, increasing trading costs.

Underlying Holdings: Understand what securities the ETF actually holds, especially for thematic or sector-specific funds.

Conclusion

Exchange-traded funds have become a cornerstone of modern investment portfolios, offering a flexible and efficient way to gain exposure to a wide range of asset classes and investment strategies. As the ETF landscape continues to evolve, investors have an ever-expanding array of options to help meet their financial goals. However, as with any investment, it's crucial to conduct thorough research and consider how an ETF fits into your overall investment strategy before investing.

Stocks to Watch This Earnings Season: October 2024

October 2024: The earnigs season is here. Today's blog provides an overview of several US stocks to watch now. It covers a wide range of sectors, including technology, energy, telecommunications and media, automotive and sustainable energy, healthcare and pharmaceuticals, and the financial sector.

This blog post is for educational purposes only. It does not offer any financial advice or investment recommendation. Please contact a registered financial advisor in your jurisdiction before investing your money.

As we enter the earnings season in October 2024, several stocks are poised to capture investor attention due to their strategic positioning and growth potential. This period is crucial for investors as companies release their financial reports, providing insights into their performance and influencing market dynamics.

Financial Sector

Goldman Sachs (GS) is another financial heavyweight to monitor, with its performance in investment banking and trading activities likely to provide valuable market insights.

JPMorgan Chase (JPM) is set to kick off the earnings season for major banks, with investors closely watching for insights into the health of the financial sector and the broader economy.

Technology Sector

Apple (AAPL) is expected to report its earnings in late October, with investors closely watching its performance in the smartphone market and its services segment. The company's recent launch of the iPhone 15 series and its foray into virtual reality with the Vision Pro headset are likely to be key focal points.

Meta Platforms (META) continues to benefit from strategic investments in the metaverse and digital advertising, positioning it well for sustained growth. As of writing, META stock is hovering around all-time highs.

Microsoft (MSFT) is poised to influence market sentiment for Big Tech as it reports earnings around the third week of October The company's focus on cloud computing and AI positions it well for continued success, making it a top pick for tech-oriented investors.

Nvidia (NVDA) remains a standout in the technology sector, particularly in artificial intelligence (AI) and graphics processing units (GPUs). Despite potential market corrections in the coming months, Nvidia's long-term growth trajectory is robust, making it a leading stock for growth-oriented portfolios.

Energy Sector

Chevron (CVX) is another energy giant worth watching, with its strong balance sheet and commitment to shareholder returns through dividends and share buybacks.

ExxonMobil (XOM) currently stands out as an undervalued stock, offering a potentially compelling investment case with its strong cash reserves and rising dividends. The company's focus on operational efficiency and strategic investments in low-carbon technologies further enhances its long-term value proposition.

Telecommunications & Media

AT&T Inc. (T) offers a high dividend yield and a potentially positive price target outlook, with strong buy ratings from analysts reflecting confidence in its ability to deliver stable returns.

Comcast (CMCSA) presents attractive valuation metrics and a commitment to returning value to shareholders through robust share buybacks and dividends.

Automotive & Sustainable Energy

General Motors (GM) is also worth watching this earnings season as it continues to expand its electric vehicle lineup and invest in autonomous driving technology.

Tesla (TSLA) remains a focal point for investors, especially with the upcoming unveiling of its robotaxi prototype, the "Cybercab." Tesla's innovative approach to autonomous vehicles and sustainable energy solutions continues to drive investor interest.

Healthcare & Biopharma

Eli Lilly (LLY) has shown strong performance in the pharmaceutical sector with its innovative pipeline and strategic acquisitions, making it a reliable choice for dividend-focused investors.