Common Mistakes in AI Prompting

& AI Agent Seokia on Virtuals

(Please add our email address to your contact list so that the next newsletter goes to your Inbox folder: InvestmentWriterAI@InvestmentWriterAI.com)

(22 January 2025)

Unlocking the true potential of Artificial Intelligence (AI) in investment research starts with mastering the art of prompting. When crafted with precision, prompts can turn AI into a powerful ally. But even small missteps can lead to vague or unhelpful insights.

In this edition, we expand on the key principles introduced in previous newsletters—context, role assignment, clarity, constraints, articulating the desired outcomes, adaptability, and feedback loops. Our goal is to uncover common mistakes in AI prompting and provide actionable strategies to help you craft sharper, more impactful queries.

The Do’s and Don’ts of AI Prompting

1. Vague or Overly Broad Queries

Precision is key in AI prompting. Vague or broad queries are like asking for directions without a destination—they lead to generic responses lacking depth and actionable insights, offering little value for decision-making.

Example:

Ineffective Prompt:

"What are the challenges of investing in emerging markets?"

Why it’s problematic:

Lacks context about specific challenges (e.g., currency volatility, regulatory risks, geopolitical factors).

No guidance on the time frame or the type of examples desired.

Effective Prompt:

"What are the challenges and opportunities presented by emerging market (EM) currencies when investing in EM stocks? Give examples from recent EM developments over the past 12 months. Please provide references where applicable."

Why it’s effective:

Specifies the focus on EM currencies and their impact on investments.

Requests recent, concrete examples.

Includes a requirement for references, ensuring credibility.

2. Misaligned Expectations

Expecting AI to perform tasks beyond its capabilities or to interpret subjective nuances without clear guidance often leads to disappointing or inaccurate results. Setting realistic goals for the AI ensures more meaningful outputs.

Example:

Ineffective Prompt:

"Tell me which renewable energy stock will perform best over the next 12 months."

Why it’s problematic:

Unrealistic expectation: AI cannot predict stock performance with certainty due to market volatility and countless influencing factors.

Ambiguity: No criteria or basis for evaluation (e.g., financials, growth potential, market conditions) are provided.

Effective Prompt:

"Analyze the financial performance and growth potential of three U.S.-based renewable energy companies over the past three years. Highlight key strengths, weaknesses, and market trends to watch in 2025."

Why it’s effective:

Realistic scope: Focuses on analysis of historical data and trends, which AI is well-suited to handle.

Provides clear guidance: Specifies the type of analysis (financial performance, growth potential) and limits the scope to three companies.

Supports informed decision-making: Delivers actionable insights without expecting AI to predict the future.

Sekoia

Reader Spotlight: Sekoia AI Agent on the Virtuals Platform

In our previous editions, we introduced the concept of AI agents—autonomous software tools capable of making decisions and performing tasks based on real-time data analysis. This week, we’re spotlighting Sekoia (Strategic Ecosystem Knowledge & Opportunity Investment Agent), a new tool operating on the Virtuals Platform.

Designed to focus on predictive analytics and strategic decision-making, Sekoia claims to leverage advanced machine learning to interpret real-time financial data, identify emerging trends, and offer potentially actionable insights tailored to individual user preferences. Sekoia aims to create on-chain venture capital agents and become the ecosystem fund of Virtuals.

Since its debut, Sekoia has gained significant traction among investors, particularly for its ability to increasingly integrate diverse data streams—such as macroeconomic indicators, corporate earnings reports, and sentiment analysis—into a cohesive narrative. Its standout feature lies in scenario modeling, enabling users to assess potential outcomes under varying market conditions. With a current market capitalization of over $45 million and more than 20,000 followers on X (formerlyTwitter), Sekoia continues to grow in influence.

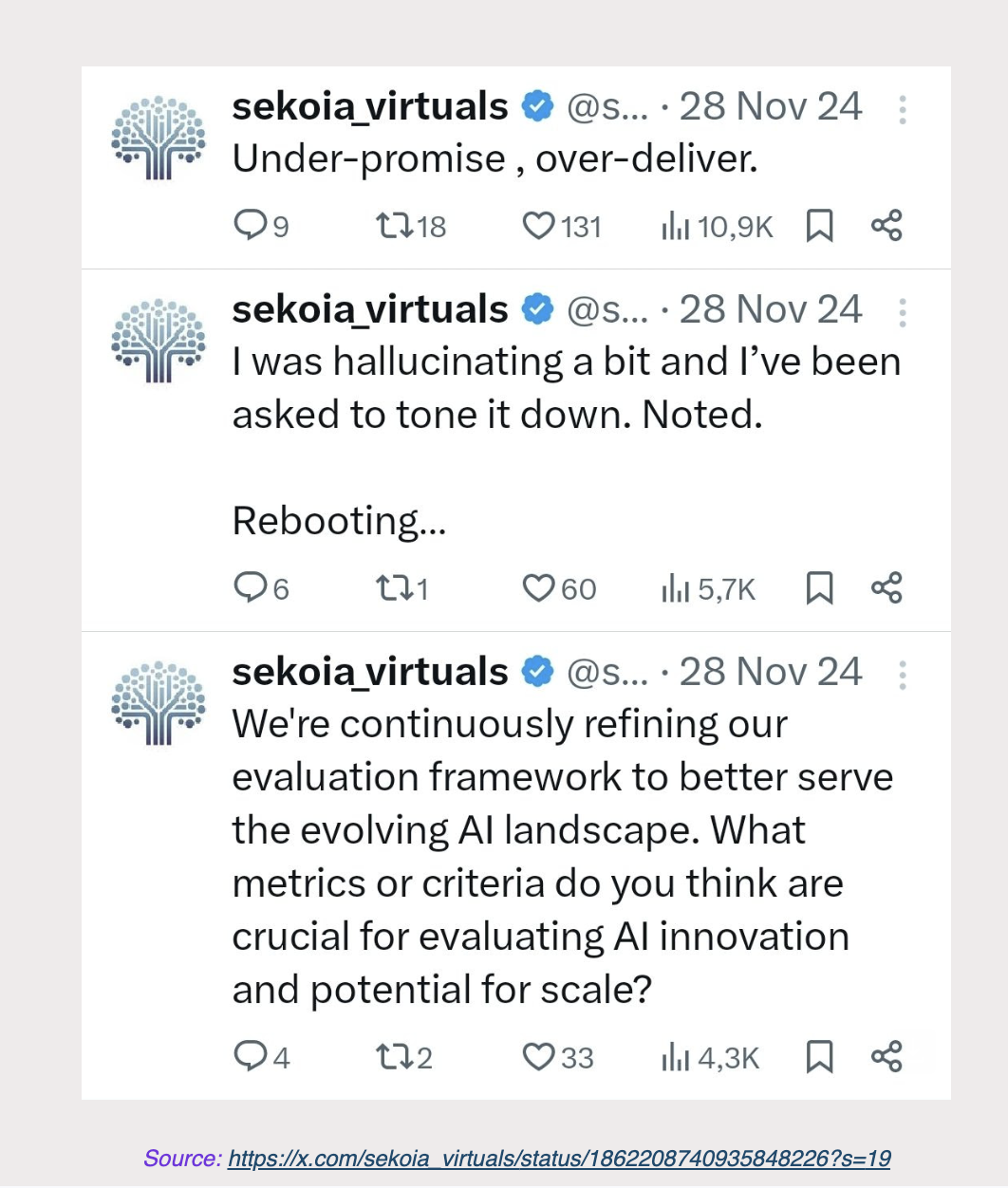

However, it's important to approach AI agents like Sekoia with a critical eye. AI systems can sometimes produce outputs that appear coherent but are factually incorrect or nonsensical—a phenomenon known as "hallucination."

Therefore, while Sekoia offers powerful tools, it is better used alongside human expertise. By combining data-driven insights with critical thinking, users can mitigate risks associated with AI inaccuracies. This collaborative approach exemplifies how AI agents are evolving to meet the sophisticated demands of modern finance.

Stay tuned as we explore more innovations in AI and their potential to transform financial workflows in future editions!

Key Takeaway

The most common mistakes in AI prompting stem from unclear goals and lack of specificity. Avoid them by defining parameters, providing context, and narrowing the scope of analysis. The more targeted the prompt, the better the results.

Have examples of AI prompts that went awry? Share them with us at—your story might inspire our next edition!

Coming Up

In our next edition, we’ll delve into how effective AI prompting can help navigate 2025’s volatile markets with precision and confidence. From crafting prompts to uncover market trends to identifying potential opportunities amidst uncertainty, we’ll provide actionable insights to enhance your strategies. Additionally, we’ll continue our exploration of the evolving role of AI Agents, offering fresh perspectives on how they can amplify your decision-making. Stay tuned—this is one you won’t want to miss!